Market Volatility

China

In July, China’s equity market suffered one of its worst monthly declines in a decade amid escalating regulatory pressures. The steep fall has raised concerns about the risks and outlook for investing in Chinese equities.

The latest trigger event was a policy update setting out new restrictions on China’s private tutoring industry. In recent months, China’s regulators have also been issuing antitrust fines, disallowing M&A activities of technology firms and focusing on cybersecurity. A recently passed data security law will also take effect in September.

We asked Noriko Chen, a portfolio manager and member of the Capital Group Management Committee, and portfolio manager Victor Kohn to share their perspectives on recent developments and potential investment implications. Noriko and Victor each has more than 25 years of experience investing in China and are portfolio managers on emerging markets-focused strategies.

What should we make of the recent spate of regulations, particularly those aimed at the education and technology sectors?

Looking at it in a broader socioeconomic context, China’s government wants social and economic stability. Everything related to people’s lives needs to be affordable ― education, health care and property. Anything working against those efforts is likely to be tightly regulated. China’s other major goal is national security, which means control of data and great self-reliance in technology.

China wants to do more to build up and strengthen the capabilities of its domestic economy. This has been previously articulated in its dual-circulation strategy; it took on greater urgency after the U.S. banned telecommunications giant Huawei and pressed other countries to do the same. We still think Communist Party officials want to help support domestic companies that can develop superior capabilities that rival global competitors in a number of areas such as technology and health care. At the same time, they want to make sure that when there are sensitive issues such as data privacy that companies follow government guidelines.

Beijing is saying it wants greater control, but that does not necessarily mean the government wants to punish any company that makes too much money, or to sharply curtail the profitability of some of the country’s most successful companies.

Let’s talk about a few areas that have been the focus of regulation. What about the internet platforms?

For the internet platform operators, the likely aim is to curb monopolistic and oligopolistic power and behavior, such as forcing merchants to sign exclusive contracts, and to limit predatory marketing practices. We believe the objective of this regulation is to foster greater competition and create an environment in which smaller businesses can thrive and consumers of those particular products pay lower prices, whether it be business to consumer or business to business.

This may mean the dominant internet companies have to open their mobile-based internet platforms to competitors. We could also see greater scrutiny of potential acquisitions. In the long run, increased competition might be a healthy development, but in the near term, we could see greater earnings volatility.

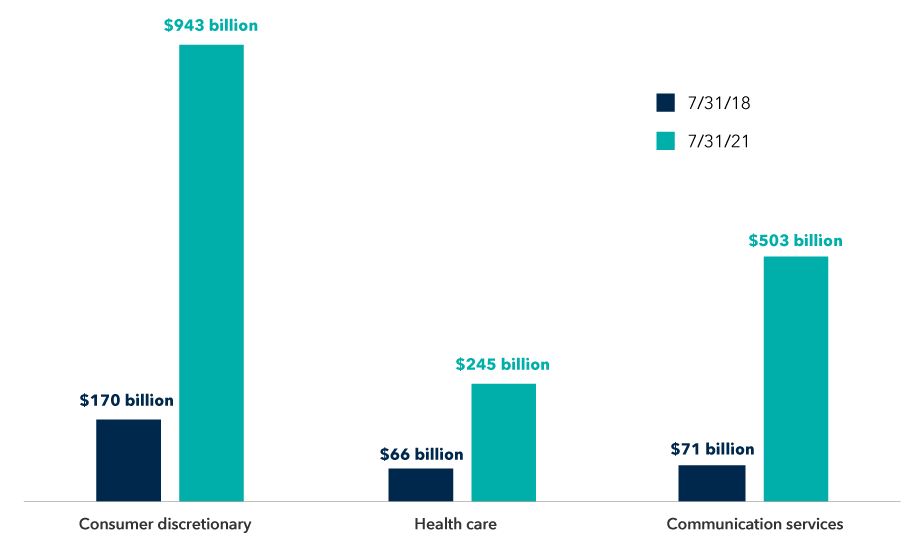

Some sectors of China’s equity market have seen rapid growth in market value

Sources: RIMES, MSCI. Data reflects market capitalization of sectors in MSCI China IMI as of July 31, 2021.

On the data front, the government has been more focused on cybersecurity and data privacy requirements since 2017, when the Cybersecurity Law went into effect. Since then, China has implemented and drafted additional laws that are increasingly strict in multiple areas, from national standards requiring localization of cloud infrastructure in China to expanding personal information security and protection where information needs to be stored onshore in China.

Potential implications for companies may include changes similar to those recently enacted in the European Union regarding obtaining and using personal data and where data may be housed. This could result in more companies localizing infrastructure, ring-fencing data domestically (i.e., putting limits on data so it can only be used by particular persons or for a particular purpose), and even a preference for Chinese companies to list on the country’s domestic stock exchanges.

What about online education? The after-school tutoring business has been largely shuttered. What other areas are vulnerable?

China’s top administrative body, the State Council, ordered companies teaching school curricula in the $100 billion after-school tutoring sector to become nonprofit entities and banned them from pursuing initial public offerings or taking in foreign capital.

These for-profit education companies were viewed as widening the economic gap as public schools were losing quality teachers to after-school private tutoring, where salaries were higher, and thus were perceived as hurting lower- and middle-income families. The after-school tutoring also led to very long school days.

No doubt, what happened in online education may extend to other industries, such as video gaming and streaming services, where there reportedly is pressure to enact more rules. Restrictions already exist to reduce the time students and young adults spend on online gaming and streaming. For private sector companies, this may hurt average revenue per user, reduce profitability and increase compliance costs.

The housing market is another area of regulatory focus. What impact do you see?

Property developers continue to face increased regulation as the government seeks to curb excessive risk and debt in the country’s financial system. The government is focused on future economic growth, and excessively high property prices hurt housing affordability. This might lead some families to have fewer, not more, children, at a time when the government has removed its one-child policy due to the country’s aging population.

Looking ahead, there could be tighter pricing restrictions in certain areas or cities. Developers may also become subject to certain financial requirements in terms of acquiring more land sites or developing projects. If this occurs, it could potentially lower a company’s long-term return on invested capital and impact its valuations. This would have the effect of transforming Chinese property developers into quasi-utilities with controls and regulations on their profitability.

Do you expect to see further regulation?

We anticipate more regulatory actions, and there could be further guidelines in areas such as consumer finance, online gaming and mobile apps.

In some areas, such as cybersecurity and digital commerce, current rule-making and stricter enforcement parallel to a degree the efforts by policymakers in the U.S. and Europe to regulate the digital economy and protect consumers.

China’s key economic priorities (2021-2025)

Sources: Capital Group, U.S.-China Business Council, Congressional Research Service and media reports.

As a result, we may continue to see increased volatility in China’s equity markets in the near term, and this may suppress valuations and elevate risk premiums. This current predicament reinforces the need for deep company-by-company research when it comes to investing in China.

And amid this sharp selloff in Chinese equities, we are weighing potential opportunities to invest in unique companies with dominant market share positions whose absolute valuations are much more palatable at current levels.

Which sectors could benefit from these recent policy pivots and regulatory actions?

While certain companies and industries face heightened uncertainty, other business areas that are more aligned with the government’s priorities may present investment opportunities. Some examples are:

Green energy is a priority, and companies helping to facilitate the transition toward cleaner energy in China could benefit from increased investment. Reducing carbon dioxide emissions is a global priority and China has been taking steps in this direction, including enacting policies aimed at curbing coal and increasing natural gas usage. The country has an aging population and pollution has led to falling fertility over the past decade, making clean air a higher priority.

The electric vehicles (EVs) market has been receiving forms of government support. China is already the world’s largest producer of batteries for EVs, which require a fraction of the parts used in ICEs. China has an advantage due to its low cost of capital, and may be able to play a far larger role in the global EV market as some Chinese EV manufacturers already make globally competitive models.

Electric vehicles (EVs) are also linked to the desire for reduced emissions and pollution. EVs require far fewer parts than internal combustion engine vehicles, and their economics are more leveraged to battery costs in addition to manufacturing scale. Chinese EV makers have an advantage due to subsidies, their low cost of capital, the development of batteries and separators domestically, and their ability to manufacture at scale. As a result, China is the largest producer of EVs globally and is poised to play a much larger role in the global EV market.

Pharmaceuticals and medical innovation have been areas of focus since 2015, based on improving access to quality medical care in China and reducing reliance on foreign imports. Regulatory reforms have drastically improved the landscape for both foreign and domestic companies and have helped bring China closer to global standards. A large number of Chinese scientists who were educated and/or employed in the U.S. and Europe have been returning from overseas to help create world-class companies involved in drug development, testing and manufacturing. This has also attracted large sums of venture capital.

Import substitutions are key to China’s effort to reduce its reliance on foreign suppliers and reflect the government’s dual-circulation strategy. While import substitution spans a range of industries, the semiconductor industry is of strategic importance. China’s government is keen to bolster capabilities in semiconductor design and manufacturing, especially after the U.S. banned Huawei and pressed other countries to do the same.

Software and information technology services are also areas of strategic investment for the government. These are underdeveloped industries, and enterprise-focused companies could benefit from increased investment while avoiding regulatory pressure aimed at consumer-facing tech companies.

Does China care about its equity markets and corporate profitability?

From our experience investing in China, we think the government is sensitive to market concerns even though the objectives of party officials can be opaque. In this latest selloff, Vice Premier Liu He and representatives of China’s Securities Regulatory Commission actively reached out to global investment banks and other market participants in an attempt to calm market concerns. They reiterated their continued support for the stock market and private enterprise, including overseas listings. They also emphasized their commitment to further opening China’s financial markets to foreign investors.

This latest bout of market turbulence underscores that investing in China involves greater risks. Since Capital Group began investing in China nearly three decades ago, we’ve learned that it is possible to identify good investment opportunities through the ebb and flow of regulation and economic downturns. It remains a classic stock picker’s market, with a growing number of high-quality companies and ongoing innovation, so we believe it’s important to invest on a company-by-company basis to gain an appropriate comfort level.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries. Small-company stocks entail additional risks, and they can fluctuate in price more than larger company stocks.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

The MSCI China Investable Market Index captures large-, mid- and small-cap representation of approximately 99% of the investable equity universe for mainland China's market. There are 986 constituents as of July 31, 2021.

Noriko Chen

Noriko Chen

Victor Kohn

Victor Kohn