Interest Rates

Currencies

Will the “bulls” or the “bears” win the argument over Bitcoin? This debate has returned to center stage with the sharp rise in the value of Bitcoin over the past year.

The bulls contend that Bitcoin represents an appreciative asset class that is an improvement upon currencies and stores of value in the long term. They argue that the technological innovation of Bitcoin gives it security, accessibility, durability, ease of storage and a supply constraint to underpin its value long term. The bears hold that Bitcoin ultimately has no intrinsic value because it cannot produce earnings and it has no direct utility or government backing.

“The growth of Bitcoin and the ecosystem around it is something I’m paying close attention to,” says Capital Group portfolio manager Mark Casey. “This decentralized, open-source, emergent phenomenon has already come a very long way since it was launched roughly 12 years ago, and there are believable future cases in which Bitcoin and the ecosystem around it become vastly more economically important and influential.”

Money serves three functions

To understand both sides of the argument and frame some context around the emerging narratives, it is important to keep in mind that money serves one or more of these three functions:

- a medium of exchange for goods and services

- a measure of value

- a store of value

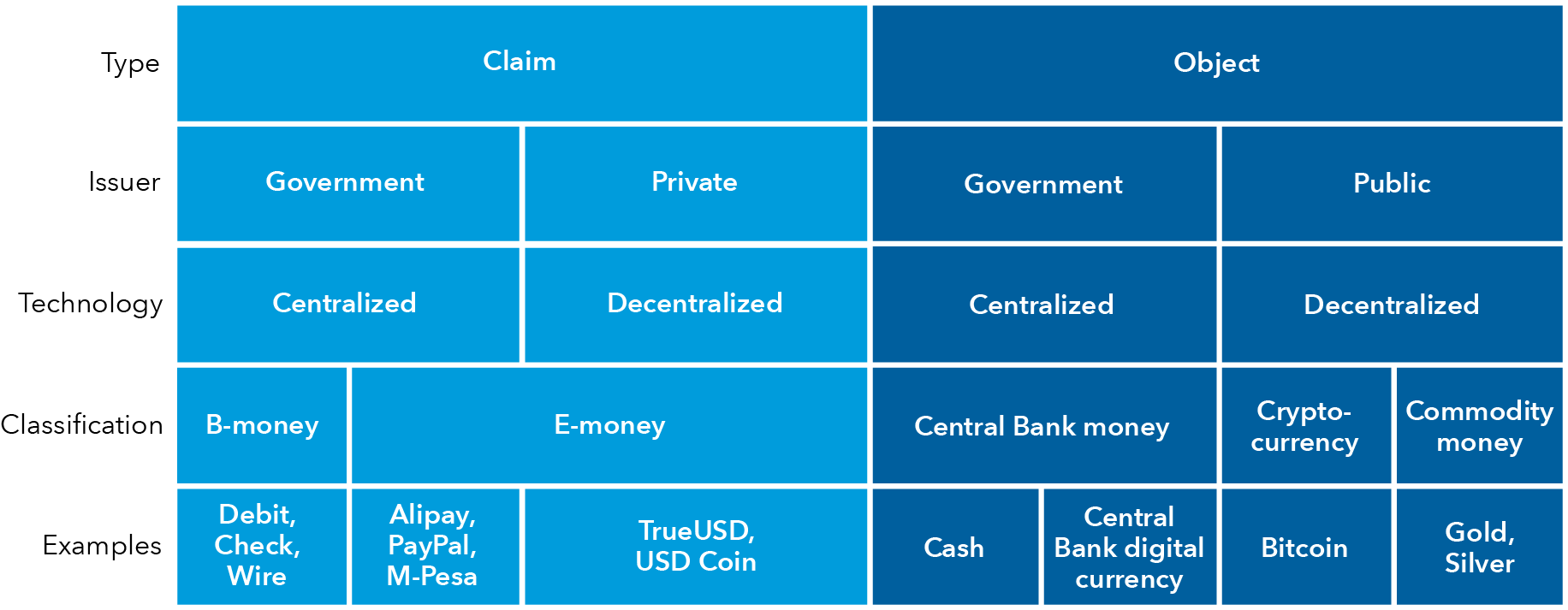

Historically, monies have varied across these functions, and a few other dimensions have emerged as important. Money is either claim or object based. Object-based monies have value in and of themselves. Claims, on the other hand, represent a right to value elsewhere.

A taxonomy of money

Chart Source: IMF, Capital Group analysis.

Money that relies on centralized technology generally has the issuers set a protocol for how the money is to be distributed and validated, whether it is an object or a claim. Fiat currencies issued by central banks, such as the U.S. dollar, and claims on bank assets (i.e., b-money) use centralized technologies. This can make settlement quite fast because you need only trust the central authority and not necessarily your counterparty, but it can also result in some exclusion — think of credit card transactions and credit access.

On the other hand, money that can be created by anyone is theoretically more accessible, even if it is less efficient to create, distribute and validate. Gold can be found by anyone and is likely to be accepted everywhere as valuable, but it is challenging to mine, purify and store, and it can also be difficult to trust those who wish to exchange it.

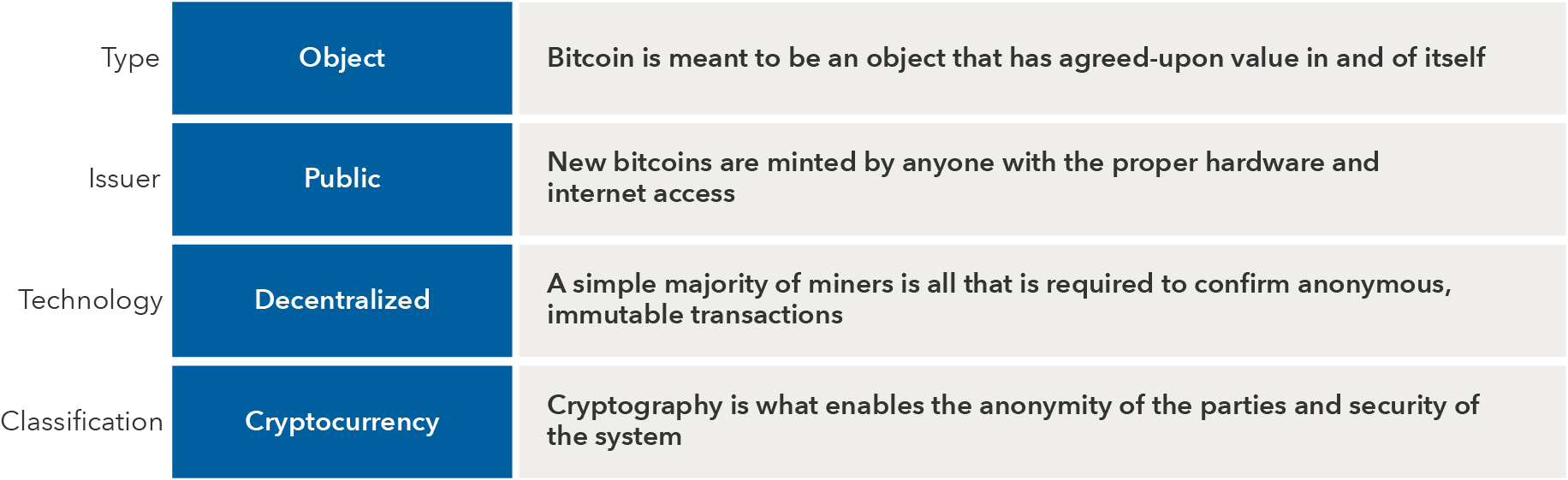

Bitcoin basics

Chart Source: Capital Group analysis.

Bitcoin’s unique characteristics

Bitcoin is the original cryptocurrency. It is a novel attempt at a money that is a digital object (i.e., valuable as itself) and is produced, distributed and validated entirely through decentralized technology. This unique approach allows it to capture some of the benefits traditionally associated with both objects and claims, and both centralized and decentralized money.

Bitcoin began circulating in 2009 after publication by an author (or authors) pseudonymized as Satoshi Nakamoto. It uses cryptography to prevent fraud and control its money supply, leveraging a blockchain that has a unique data structure and protocol to enable a global open network of anonymous “miners” to maintain its ledger.

This novel approach to money gives it many advantages over others: It is highly divisible (up to 1/100,000,000, or 1 “Satoshi”), durable, storable and incredibly secure. However, it is still nascent and, therefore, not as ubiquitous as a true medium of exchange should be.

Bitcoin also faces scaling challenges in regard to transaction times, which may limit its potential as a medium of exchange. It is not a widely used unit of account, which is required of a standard measure of value. It has also been highly volatile, which may limit its potential as a true store of value.

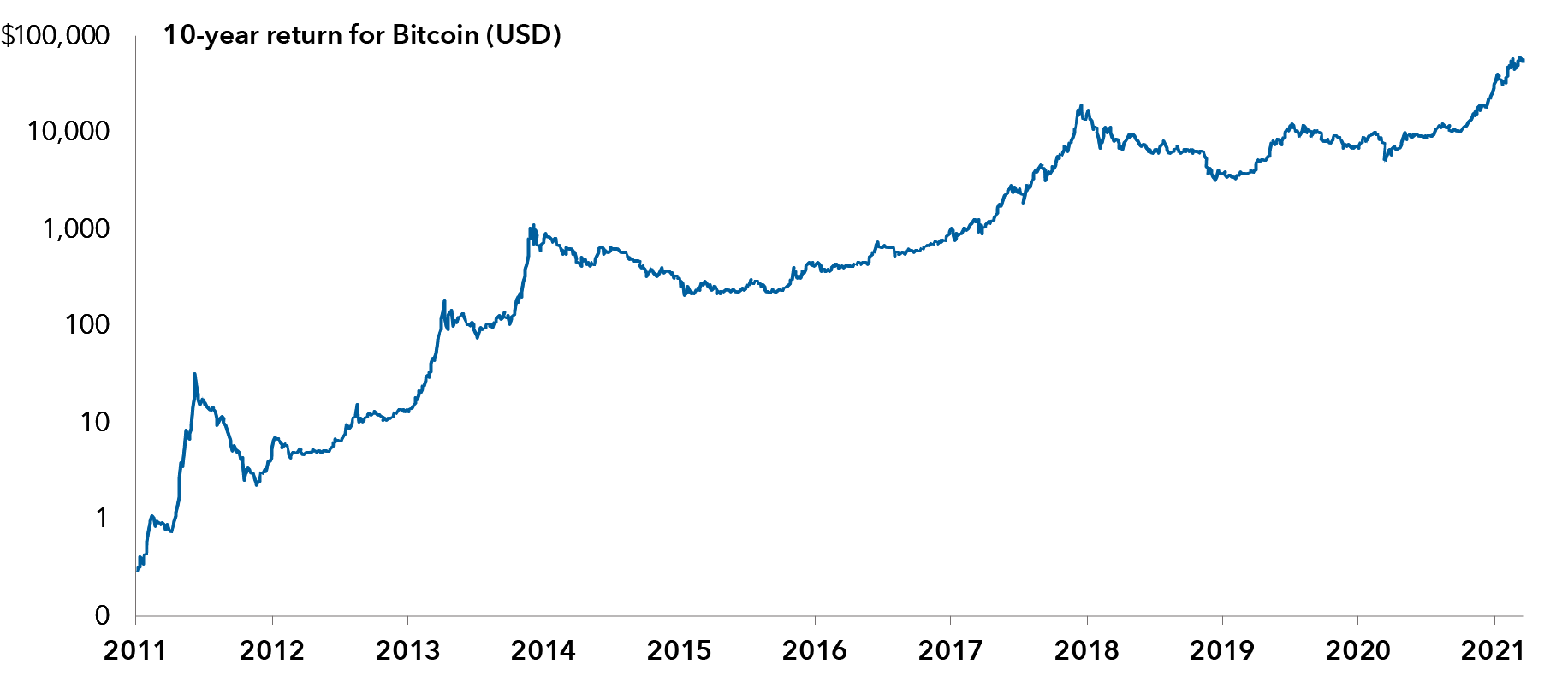

Bitcoin’s meteoric rise

Chart Source: Blockchain.com. Data as of March 23, 2021.

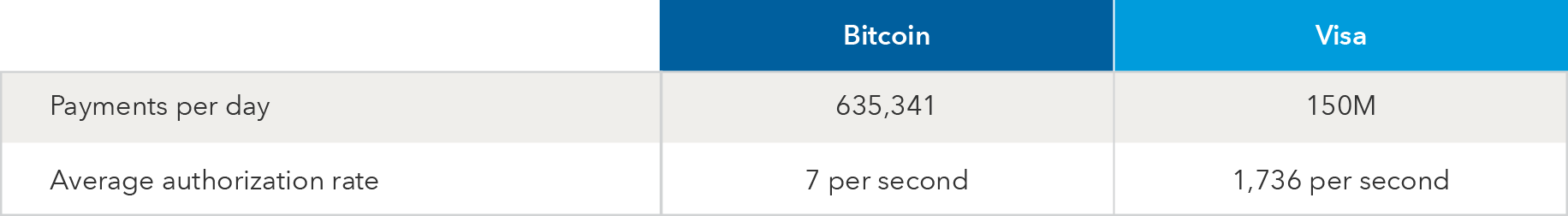

How Bitcoin stacks up as a medium of exchange

Bitcoin ranks favorably on many of the traits of a good medium of exchange. Its use of cryptography and decentralization create a network that makes it difficult to seize/steal someone’s Bitcoin or assume their identity. This does not mean that Bitcoin cannot be used to commit fraud. It means that vulnerabilities occur due to human error or bad actors as intermediaries, rather than due to the code that keeps the blockchain running.

Assessing the speed of Bitcoin as a medium of exchange has two dimensions. There is the speed of confirming/authorizing a payment, and then there is the speed of settling a payment. In smaller physical cash transactions, there is no time spent confirming a transaction beyond counting the bills exchanged (assuming they are not counterfeit, and indeed with large cash purchases some additional anti-counterfeit verifications will be required). Settlement is done instantly with the physical movement of the cash.

With common payment methods like a Visa card or a PayPal account, payments are authorized almost immediately. However, it can take one to three business days for a transaction to settle, or for the actual funds to move from buyer to seller. This is because b-money (e.g., debit, checks) and e-money (e.g., PayPal) are claims on fiat currency held in banks. Visa and its partners have a protocol for authorizing transactions, batching and netting them out before issuing funds. This gives a fast authorization time despite a slow settlement speed.

Similar to cash, Bitcoin has instant settlement at the time the transaction is authorized. But, to ensure the security of the network/protocol, authorization time is longer compared to cash or credit card networks.

Chart Sources: Visa, Blockchain.com. Data for Visa as of August 2010. Data for Bitcoin as of March 23, 2021. It reflects averages over the last 12 months. A Bitcoin transaction can contain multiple payments. Average authorization rate is defined as the average time for a transaction with miner fees to be included in a mined block and added to public ledger (i.e., included in six blocks).

Bitcoin is not as ubiquitous as cash, b-money or e-money, and this has hurt its effectiveness as a medium of exchange. It is difficult to estimate the total number of Bitcoin users for a few reasons: All the addresses on its blockchain ledger are anonymous, individuals can have as many addresses as they wish and intermediaries can hold thousands of users’ Bitcoin together in a single address. Still, estimates for the total number of Bitcoin users range from only about 21 million to 101 million.

However, there are some encouraging reasons to believe that Bitcoin has potential to become more ubiquitous as a medium of exchange. For example, Visa’s CEO recently stated that their strategy is to work with Bitcoin intermediaries “to enable users to purchase these currencies using their Visa credentials or to cash out onto our Visa credential to make a fiat purchase at any of the 70 million merchants where Visa is accepted globally.”

Mastercard recently said in a blog post they will start supporting select cryptocurrencies directly on their network. What this looks like specifically isn't yet clear. They further shared: "We are here to enable customers, merchants and businesses to move digital value — traditional or crypto — however they want. It should be your choice, it’s your money."

Meanwhile, PayPal has already launched the ability to buy, sell and hold cryptocurrencies including Bitcoin, Ethereum, Litecoin, and Bitcoin Cash within PayPal. They intend to extend these services to select global markets in the first half of 2021 and expand the same functionality to the popular payments app Venmo.

But none of these payment networks are enabling direct peer-to-peer or peer-to-merchant Bitcoin transactions yet. For now, customers holding Bitcoin and wishing to use it to pay will have to convert to the fiat unit of account in order to execute their transactions. Even so, perhaps these are the beginnings of an infrastructure that will eventually support Bitcoin denominated transactions. PayPal competitor Square just launched peer-to-peer Bitcoin transactions through its Cash App as well as cash back in Bitcoin.

In the U.S., regulators are opening the door to traditional banks and custodians providing services on crypto assets. The U.S. Office of the Comptroller of the Currency published a letter in July 2020 clarifying that national banks and federal savings associations have the authority to provide cryptocurrency custody services for their customers. Bank of New York Mellon said in February that they intend to offer custody services for Bitcoin and other cryptocurrencies later in the year.

“I’m watching closely to see how financial technology companies make use of the Lightning Network, a nascent but promising architecture which allows Bitcoin users to transact with the same speed and frequency currently delivered by traditional payment networks like Visa and Mastercard, and potentially at even lower costs and in even smaller minimum transaction sizes than Visa and Mastercard support,” says Casey.

“One startup I’m watching allows Bitcoin users to pay a penny or even less to listen to a single podcast or to watch a single video,” he adds. “Widescale adoption of this type of ‘micropayment’ technology could enable huge new revenue generation possibilities for content creators and various types of content distributors.”

How Bitcoin stacks up as a measure of value

For Bitcoin to become a unit of account used to measure value, it needs to dominate transactions in a way that even those not involving Bitcoin are denominated in it.

Bitcoin does have a few qualities that make it an effective measure of value. It is fungible: No Bitcoins are worth any more or less than others. It is also highly divisible. Divisibility matters because it enables transactions to scale at various units. Most major fiat currencies can only scale down to cents or mills (two to three decimal places), and thus far that has been useful enough.

Still, for most, it’s more common to think of paying for goods and services in their local currency, not in Bitcoin or a subunit like “bits.” Like most new things, it will take time for a shift in mindset to take hold among the general public, and there is no guarantee Bitcoin will become ubiquitous enough for this shift. Recognition and use by central banks and governments bolsters the ubiquity of fiat currencies, but so far we have not seen any indications of this for Bitcoin.

To become a unit of account, people would have to think of measuring the value of goods in Bitcoin terms. Take a loaf of white bread as an example. The average cost per pound is roughly $1.50 in the United States. This would equate to 28 bits (units of Bitcoin at the 6th decimal) at recent USD/BTC exchange rates (as of March 23).

How Bitcoin stacks up as a store of value

Bitcoin has been likened to “digital gold,” and in some ways this is an apt analogy. Bitcoin is like gold in that it is not issued by the government or a private entity. It does not have a jurisdiction and its distribution is decentralized. As a store of value, both Bitcoin and gold are highly durable.

Yet, gold has the advantage of having thousands of years of circulation in many different societies, giving it greater ubiquity and stability of value. Capital Group portfolio manager Paul Benjamin says that “gold’s primary appeal comes from being a 5,000-year-old currency whose supply grows much more slowly than most fiat currencies. Historically, gold has performed very well during periods of financial repression, when interest rates are lower than the inflation rate.”

The market cap of Bitcoin is roughly about one-tenth that of gold. “Bitcoin, being newer, with a much less established monetary brand, is far riskier. However, there is upside potential. Being digital, it is far more accessible, easy to use and move around. Historically, whenever a digital replacement comes along for something analog, there have been cases where the digital version ends up being more valuable than the analog predecessor. A few examples are that of Google, which is worth infinitely more than white pages, Facebook is worth more than any newspaper and Apple is worth more than any prior telephone maker,” says Benjamin.

Bitcoin may have some benefits versus gold in some respects: It is more divisible and accessible, more challenging to defraud or steal, and much easier to store. Critically, it has a fixed supply capped at 21 million Bitcoins.

Ultimately, a form of money does not need to fulfill all functions well in order to remain valuable. Gold itself is not a useful medium of exchange today, but it is still an asset with significant demand. Its scarcity has led central banks to use gold as a hedge against fiat currencies. Plus, it has commercial applications, which accounted for 46% of demand in 2020. Whether commercial applications of a money make it a better or worse kind of money is up for debate.

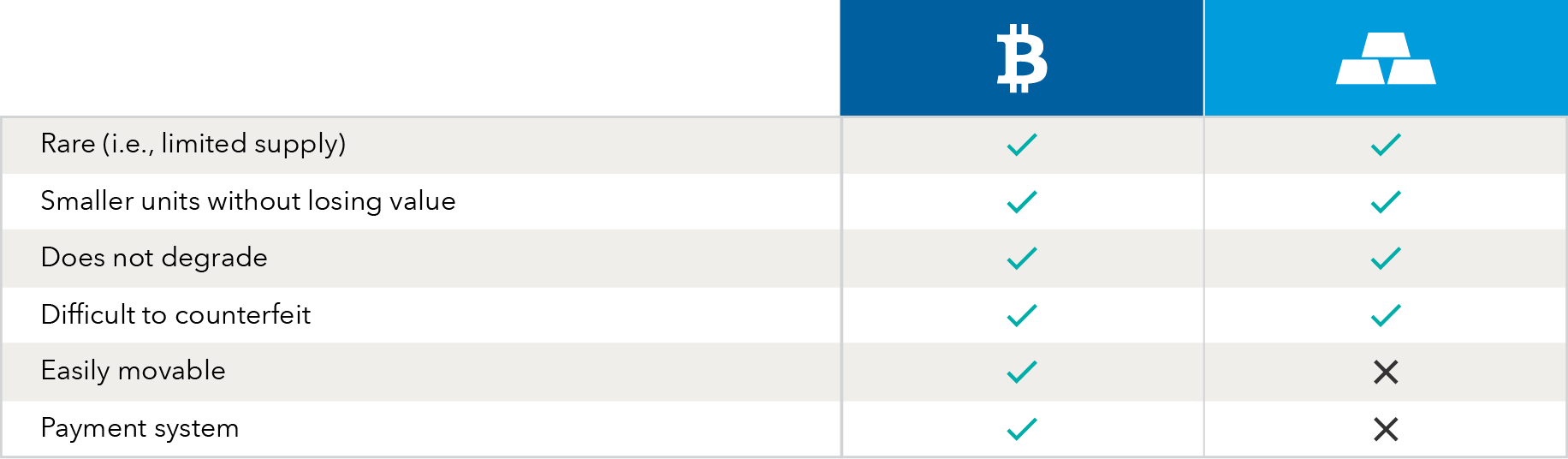

Characteristics of Bitcoin and gold

Chart Source: Capital Group analysis.

While Bitcoin has yet to find significant commercial uses, some institutions have recently begun using Bitcoin as a replacement for other assets (e.g., cash and cash equivalents, marketable securities, fixed income and equity investments) as part of their overall Treasury strategy. The software company MicroStrategy recently paid $2.2 billion for approximately 91,000 bitcoins to avoid declines in the purchasing power of the dollar. Similarly, Tesla purchased approximately $1.5 billion of bitcoin as part of an evolving strategy to manage their assets.

Although a multitude of narratives around Bitcoin have emerged, many can be housed under a framework that considers the various functions of money. At present, Bitcoin is limited on many of those functions, but its value will ultimately depend upon how well it fulfills the purpose that it serves for its holders compared to other assets.

How is Capital Group approaching Bitcoin?

As of now, Capital Group does not invest in Bitcoin or any other cryptocurrencies. Any new type of asset must be approved internally, and cryptocurrencies have not been approved for purchase within our strategies and funds. Within Capital, there are differing views among portfolio managers and analysts. While the long-term use cases for Bitcoin and other cryptocurrencies may have the potential for success, we know that nothing is certain. Even with many favorable qualities that suggest Bitcoin can fill a role in financial markets in the long term, we have seen extreme short-term volatility. As such, it may take longer for Bitcoin to become a more ubiquitous medium of exchange or store of value than the bulls expect, but it also may not vanish as the bears expect.

Bobby Esnard

Bobby Esnard