Client Relationship & Service

Tax & Estate Planning

- Aretha Franklin’s lack of a will shows even high net worth clients have holes in their estate plans.

- A majority of Americans don’t have wills.

- RIAs are uniquely positioned to help clients — by serving as estate-planning point people.

Singing legend Aretha Franklin may have commanded “Respect,” but one thing she lacked was a will. Seeing such a prominent high net worth individual die intestate is a call to RIAs to “Jump to It” when it comes to estate planning.

The fact that Franklin, famously secretive about her finances, died without a document so integral to a financial plan is telling. As a result, her family is now in a situation where private details could potentially become public. Franklin joins other celebrities such as Prince, also guarded about financial matters, who surprisingly died with no will.

“I think the surprise comes from the fact that these are people who can afford great talent to support them and to advise them (on estate planning),” says Jeff Brooks, a wealth strategist at Capital Group. “She didn’t follow it.”

Not just Aretha

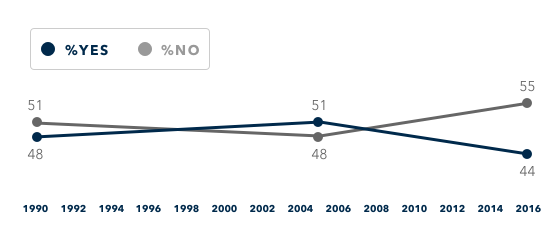

The lack of a will is a widespread issue RIAs are uniquely positioned to rectify. Just 44% of Americans report having a will in place to direct how their money and estate is handled after death, according to a Gallup® poll conducted in 2016. That’s down from the 51% of Americans with a will in 2005 and even lower than the 48% of Americans lacking a will in 1990.

Most Americans lack a will

Do you have a will that describes how you would like your money and estate to be handled after your death?

Source: Gallup

Certainly, the problem is more serious among younger clients still building wealth. Just 14% of Americans who are younger than 30 have a will. But it’s not just an oversight connected with an abundance of time and lack of money. A quarter of upper-income Americans aged 55 and older report not having a will in place, Gallup found, defining upper-income as households with $75,000 or more in annual income.

What RIAs should do

RIAs are usually not attorneys, but they still play a pivotal role in building a complete estate plan, Brooks says. RIAs are uniquely positioned to be a general contractor and to “really take the side of your client” when it comes to creating an estate-planning strategy.

For instance, if a client is looking to insure an inheritance for heirs, meeting with a life insurance salesman will likely focus on one potential solution. An RIA could consider insurance as an option, but might also look at investing or saving too. The best solution might be a combination of all three approaches.

How can RIAs play an important role to make sure clients have the proper documents in place? Brooks offers three suggestions:

1. Build a library of resources and line up a go-to estate-planning professional.

RIAs don’t usually see providing legal or tax advice as their role, yet clients expect estate matters to be factored into a plan. RIAs should have libraries of documents on wills, trusts and tax consequences of transfers during life or death at the ready. It’s also important to forge relationships with trusted estate-planning attorneys so you can get legal counsel when making decisions.

Understanding the role of estate planning is more nuanced following 2018’s sweeping tax reforms. Now, the federal estate tax exclusion doubles to $11 million for individuals and $22 million for couples. Very few estates are this large, which means most clients can pass that much to anyone without any estate or transfer tax.

This shifts many of the benefits of estate planning away from tax planning to more financial control. Due to “step-up-in-basis” rules, many clients may decide it’s best to die with all their assets in their taxable estates rather than dripping out gifts over time. That means tax reform “allows us to focus on the truly important part of estate planning — how I distribute my money — in a way that is beneficial, not a burden,” Brooks says. “Taxes are secondary.”

2. Factor in estate-planning considerations when making goals-based investment decisions.

RIAs often focus on investment returns relative to benchmarks. But what’s most important is knowing how to manage all transfer costs, administrative costs and tax consequences of decisions that go behind a goal.

“Good financial planning for our clients doesn’t stop at (kids) going to college or retirement or the purchase of a boat,” he says. “It’s also to take it to the next step to the next generation.”

How to get started now:

Do this by asking clients if they have an estate plan. “It’s a trick question. Everyone has an estate plan,” he says. What you’re really asking is if clients have “proactively planned their estate or are they simply allowing the laws of the state in which they live to create the plan.” You’ll also want to know where estate-planning documents are stored and when they were last updated. You might also consider where ethical wills fit in.

3. Find out what the kids know – and coach clients on what they should know.

Many RIAs have estate plans in place for their high net worth clients. They have assets in revocable trusts, have implemented will and trusts, and have safeguarded documents. But the missing piece is often asking clients, “Have you discussed this with your children?”

For instance, Brooks says children of high net worth clients he works with would often be disappointed after the death of their parents to find assets left in trust. They thought it showed a lack of trust in their judgment. Brooks often finds himself explaining to beneficiaries that wasn’t the case — it’s simply prudent estate planning. But he thinks parents would benefit by discussing things sooner. “It makes more sense for their parents to give them that message than allow me (as an estate planning professional) to do so,” he says.

How to get started now:

It’s up to planners to make sure clients think about matters that might be uncomfortable – even bordering on what might seem impolite. Urge clients to talk to their beneficiaries about their plans, while they still can.

“People don’t like talking about their own death, and yet the one thing they say about life — no one gets out alive,” Brooks says.

RELATED INSIGHTS

-

How to create a repeatable, referral-generating onboarding process for new clients

-

Traits of Top Advisors

4 ways to build a brand that fits your client -

Practice Management

RIA leaders weigh in on three key industry issues

Use of this website is intended for U.S. residents only.

Jeffrey Brooks

Jeffrey Brooks