Global Equities

Municipal Bonds

These are strange times for municipal bond investors. Not so long ago, volatility hit dizzying heights and valuations plummeted as an economic shutdown threatened fundamentals.

Fast-forward to the present and more than one trillion dollars of stimulus combined with a resurgent economy have supported a remarkable turnaround. Fundamentals are now on a firmer footing than pre-pandemic. Valuations have rarely been as high and yet, investors are still turning to municipal bonds in droves — seeking both income and shelter from potential tax hikes. Welcome to muni land, 2021-style.

“I’m generally taking a cautious approach, despite the strong fundamental outlook,” says Courtney Wolf, a portfolio manager on The Tax-Exempt Bond Fund of America®. “Current valuations don’t reflect significant concerns about higher interest rates, in my view. We could see some market softness in coming months as worries around higher rates ebb and flow. As a long-term investor, volatility can actually be your friend, creating opportunities to buy bonds at more favorable valuations,” Wolf adds.

In this peculiar environment, here are four things we think investors should keep an eye on: tax hikes, transport, travel and Treasuries. We call them the 4 Ts.

1. Tax hikes: Gimme shelter

If you’re not a billionaire or a Fortune 500 corporation, where can you readily seek some shelter from taxes? For more and more investors — especially those in upper income tax brackets — one answer is municipal bonds.

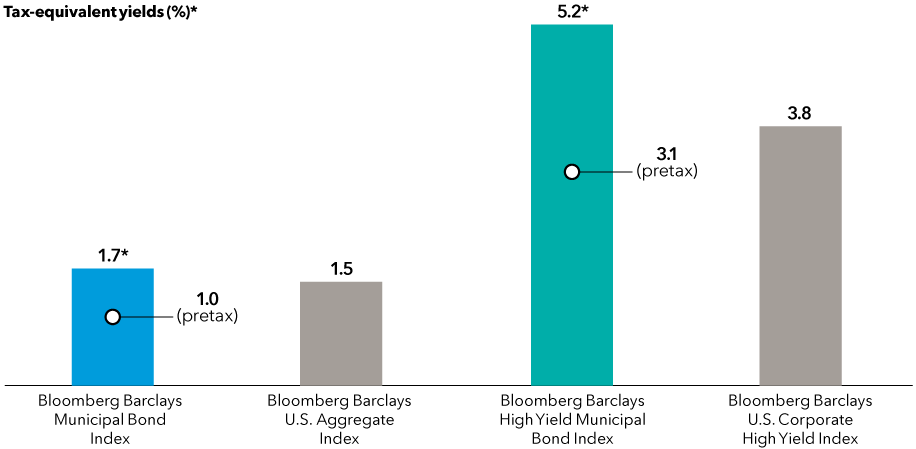

Municipal bonds look set to be one of 2021’s hottest asset classes. The reason for this resurgent popularity is clear: In a world of low interest rates, tax-free income is king. Relative to similarly rated taxable bonds (where valuations are arguably more stretched), municipals continue to offer yield advantages for investors in the top income tax bracket. Currently, we’re seeing pockets of decent value across many sectors and among high-yield issuers.

If you think tax hikes are coming, municipal bonds should be front and center in your thinking. Tax exemptions offered by this asset class will become even more valuable — if any of the proposals for higher taxes are enacted.

When you consider taxes, municipal bonds can still offer a yield advantage

*Tax-equivalent yield assumes the top federal marginal tax rate for 2021 of 37%, plus the 3.8% Medicare tax.

Source: Bloomberg Index Services Ltd. As of 6/30/21. Taxable-equivalent yield of a municipal bond investment is used to assess its attractiveness relative to taxable bonds. Put simply, it’s the answer to the question: What yield would a taxable bond have to offer in order for it to offer the same amount as this municipal bond investment, after tax?

2. Transport: Zoomshock disrupts

From remote working to food delivery, many Americans are still keeping it local. Even as offices reopen and restrictions ease, many of us will likely continue to spend more time and money closer to home.

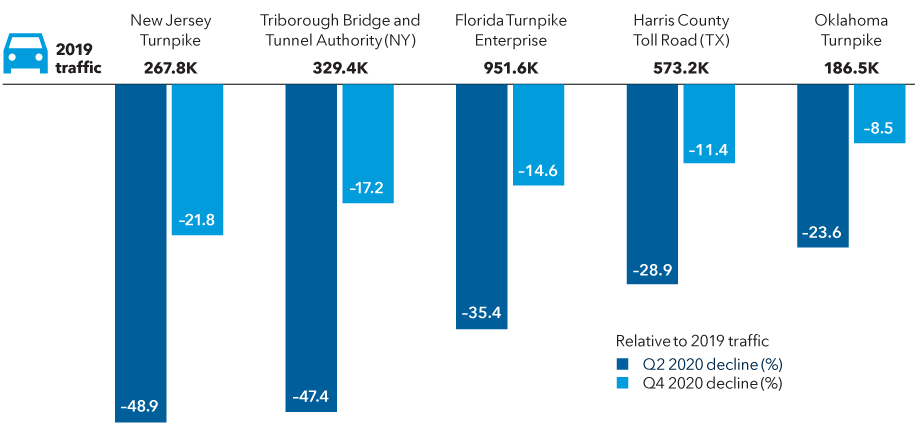

Economists have dubbed the resulting economic shake-up zoomshock — and its impact on revenues among transportation-related municipal issuers is both profound and divergent.

Toll road muni bonds have been one of the first parts of the sector to rebound. Systems in Texas, Florida and Oklahoma are among those to lead the way amid less restrictive lockdown measures. Traffic volume is rising across America, and looks set to reach 2019 levels in 2022. Crucially, for those locations where demand doesn’t fully recover, many operators can adjust toll rates to try to compensate. Managed lanes, like express and HOV, are one risk to revenues that we’re monitoring carefully.

In contrast, public transportation’s recovery is taking time and the outlook is mixed. Even the nation’s largest agency has yet to fully recover: Ridership numbers for the New York Metropolitan Transportation Authority are climbing steadily, but still remain well below pre-pandemic levels.

On the last Monday in June, for instance, ridership on the New York subway (part of the New York MTA) was about 2.25 million — less than half the figure from two years earlier. What’s more, a permanent decline in New York MTA ridership of 20% is possible, according to Moody’s Investors Service. This may trim revenues by as much as 8%.

Broadly, prospects for public transportation agencies are uncertain. How many commuters will permanently ditch mass transit in favor of driving themselves? How persistent will new remote working arrangements prove? Will already heavy local and state government subsidies increase to make up for revenue shortfalls? Answers to these questions should become clearer by year-end, and will help shape the long-term outlook.

Toll road to recovery: Traffic data from a selection of systems shows progress

Source: Fitch Ratings. Latest data available as of June 2021.

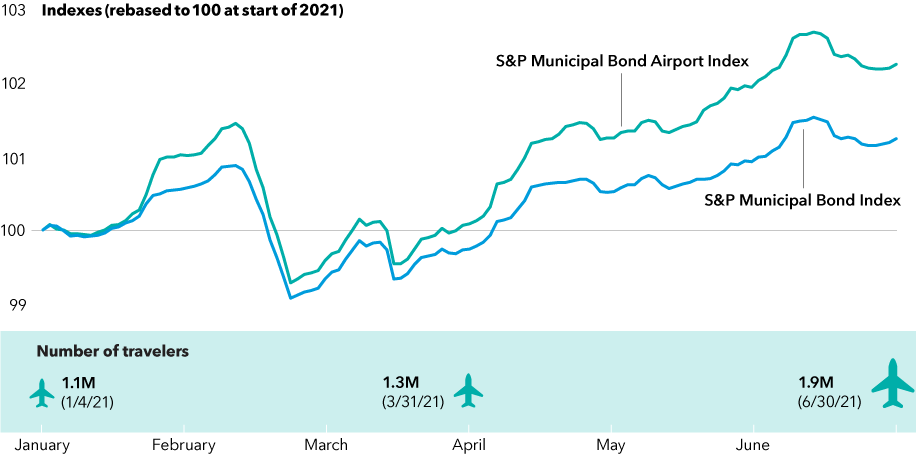

3. Travel: Wanderlust rallies

Muni bonds backed by airport revenues were among the hardest hit corners of the market in the pandemic’s early days. By the end of 2020, passenger traffic was still down 65% relative to 2019 levels, according to Fitch Ratings. Checkpoint travel data from the U.S. Transportation Security Administration for the final Monday of June shows “traveler throughput” of 1.9 million. That’s more than three times the figure for the same date last year, but it’s still only 85% of the daily level two years ago.

Since this recovery has been driven by domestic leisure traffic, the key uncertainty going forward is the return of business and international travel. Progress on vaccine distribution, the relaxation of quarantines, increased capacity at restaurants, theme parks and resorts, and the start of peak leisure travel season should continue to support a meaningful recovery.

We anticipate that business travel will climb over the next six months as employees return to their offices. On the other hand, international travel could lag as COVID-19 variants and slower international vaccine programs create headwinds.

Overall, airport fundamentals look robust. After receiving billions of dollars in stimulus, airports have navigated the pandemic with strong balance sheets and cash positions. Infrastructure proposals may support future capital expenditure.

Airport bonds have outpaced the broader market by about one percentage point so far in 2021. We think there’s a good chance that they could extend their rally as global economies reopen and public confidence in travel returns.

Airport municipal bonds have outpaced as travel restrictions ease

Sources: S&P Dow Jones Indices LLC, U.S. Transportation Security Administration (TSA). Data for 1/4/21 through 6/30/21 for the S&P Municipal Bond Index, S&P Municipal Bond Airport Index and TSA checkpoint traveler throughput.

4. Treasuries: Fed fears to fuel favorable muni entry points?

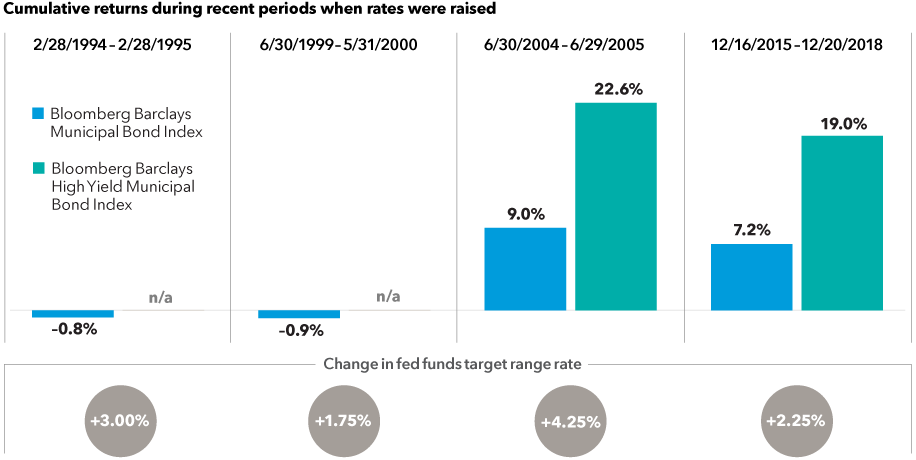

When yields rise, bond values decline. No wonder bond math has spooked some investors in 2021. Concern about inflation has helped push U.S. Treasury yields higher as investors fret that the Federal Reserve may deem it necessary to hike rates sooner than planned.

Volatility among Treasuries sometimes spills over into municipals. As the U.S. economy booms, interest rate volatility could buffet the tax-exempt asset class. With that in mind, it seems prudent to consider taking less exposure to the prevailing level of interest rates than the broader market. Putting greater emphasis on muni bonds of shorter maturity is a straightforward way to achieve this lower duration.

And, with a long-term perspective, any near-term market setbacks can have a silver lining: the opportunity to invest in bonds offering higher tax-exempt yields.

Time and again, the Fed has indicated it will be patient when it comes to scaling back bond purchases and raising interest rates. Therefore, we don’t expect the Fed to hike rates anytime soon. For those who disagree and feel that now’s not the time to own bonds, history may offer a valuable insight. The last four times rates were raised demonstrate it’s possible for municipal bonds to show limited downside — or even gains — in Fed hiking cycles.

Gains, as well as modest declines: Municipal bonds and past Fed hikes

Source: Bloomberg Index Services Ltd. Daily returns unavailable prior to 2006; results prior to 2006 were calculated using nearest month-ends to the first and final hikes. High-yield muni results unavailable pre-2003.

The economic recovery and stimulus already appear to have put municipal credit fundamentals on a firmer footing than before the pandemic. For instance, Moody’s Investors Service just upgraded the State of Illinois for the first time in more than two decades. This support could help sustain robust fundamentals for years to come. And, if Washington manages to pass an infrastructure bill, it could serve as an additional tailwind for credit improvement in a number of sectors.

That said, high valuations and gains over the past year suggest it’s reasonable to anticipate muted return potential for the remainder of 2021. With careful bond-by-bond research, however, selective investors should still be able to find pockets of value.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds. Income from municipal bonds may be subject to state or local income taxes and/or the federal alternative minimum tax. Certain other income, as well as capital gain distributions, may be taxable.

Methodology for calculation of tax-equivalent yield:

Based on 2021 federal tax rates. Taxable equivalent rate assumptions are based on a federal marginal tax rate of 37%, the top 2021 rate. In addition, we have applied the 3.8% Medicare tax. Thus taxpayers in the highest tax bracket will face a combined 40.8% marginal tax rate on their investment income. The federal rates do not include an adjustment for the loss of personal exemptions and the phase-out of itemized deductions that are applicable to certain taxable income levels.

Bloomberg Barclays U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. Bloomberg Barclays U.S. Corporate High Yield Index covers the universe of fixed-rate, non-investment-grade debt. Bloomberg Barclays Municipal Bond Index is a market value-weighted index designed to represent the long-term investment-grade tax-exempt bond market. Bloomberg Barclays High Yield Municipal Bond Index is a market value-weighted index composed of municipal bonds rated below BBB/Baa. Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, “Bloomberg”). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The S&P Municipal Bond Index is a broad, market value-weighted index that seeks to measure the performance of the U.S. municipal bond market. The S&P Municipal Bond Airport Index includes bonds from the airport sector in the S&P Municipal Bond Index. Copyright © 2021 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

For financial professionals only. Not for use with the public.

Neil Amirtha

Neil Amirtha

Greg Ortman

Greg Ortman