Client Relationship & Service

Practice Management

- Clients aren’t impressed with complexity. They want advisors who can keep planning simple.

- RIAs must guard against the industry’s push to complicate things.

- There are steps RIAs can take to keep their practices elegantly simple.

Alex Brown, like many CPAs, can delve into the most arcane areas of tax and estate planning law if you really want him to. But he knows something else impresses most clients much more: simplicity.

Brown, a partner at Genovese Burford & Brothers in Sacramento, Calif. for roughly 15 years, vividly recalls sitting down with a client earlier in his career that framed his approach ever since. Brown explained the wide range of services the firm could provide to a client. At the end of it, the client had just one question: “All I want to know is am I going to be able to retire?” Brown recalls. “It made me think about what really is important for the client, and I found that it’s not that complicated.”

Brown’s revelation is important for RIAs to hear. There’s a constant temptation for advisors to make things complicated. New financial products and technology, an eagerness to impress clients with knowledge or a desire to put on an air of sophistication pull advisors toward complication. But Brown fights against this at his 30-year-old RIA firm, which has more than $2 billion in assets under management. And he says simplicity is a key reason for the firm’s long-term success.

“This idea that you acquire a client … and you help them through the challenges they have (and show them) they’re going to be fine,” is how you build a practice, Brown says. “Our firm has entirely been built on organic growth.”

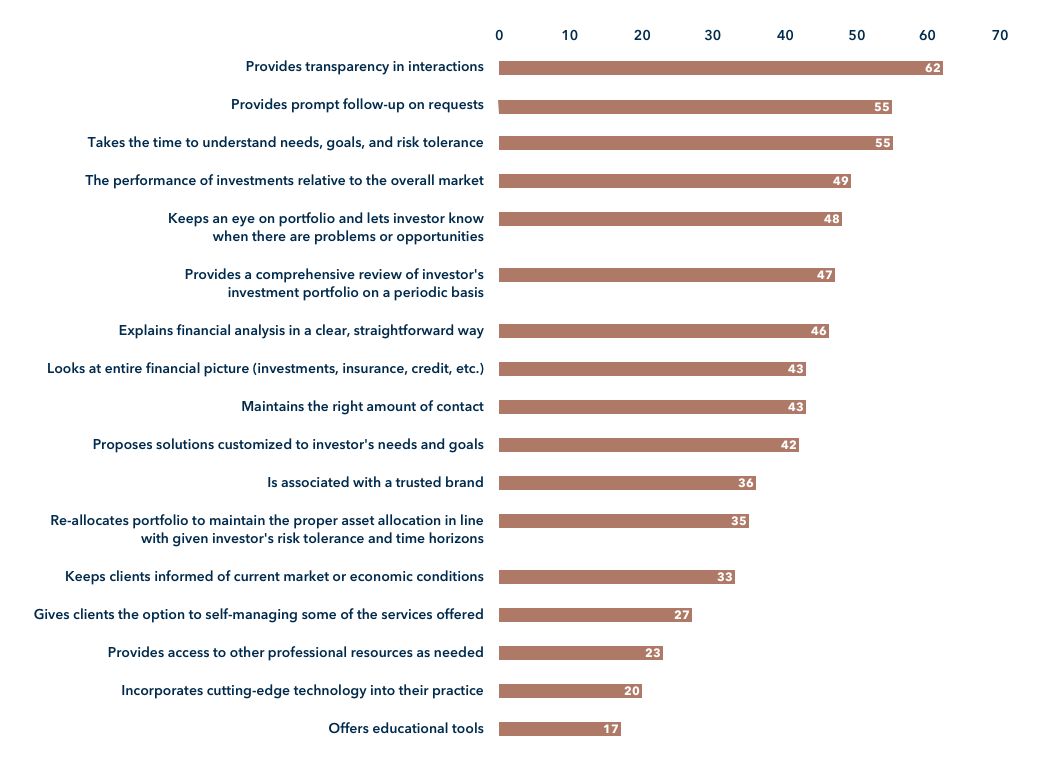

Data bears out the value of simplicity. A majority of clients choose advisors who understand their needs, can explain the plan to them and keep them informed. That’s it. Complexity like cutting-edge technology almost ranks dead last.

What clients look for when seeking an advisor

Percentage named by all households

Source: Phoenix Marketing International, Cerulli Associates

Combating complexity

Heading off complexity can be difficult, but Brown offers the following suggestions on how to do it:

- Focus on client contact.

It’s impossible to call every client every day as Genovese Burford & Brothers grows. Conversations and connections, though, are core to the firm’s strategy. To strike a balance, Brown is very regimented about keeping a line of communication open.

How?

Brown writes an in-depth quarterly note to clients. The firm also holds monthly teleconferences with clients where “we answer questions they may have, talk about markets, maybe the changes we’re making in portfolio (and) address concerns that they may have that are going on,” Brown says.

Brown is also available for in-person meetings, which are focused on the overall client objective. Sometimes individuals might feel like they are “walking in the dark.” Communication should “create some clarity and you can bring some light to the path they’re taking,” he says.

Brown recalls sitting down with a client who was preparing to retire. What was most important to this client? It wasn’t advanced tax planning or estate-planning strategies. This client simply wanted to know he would get income direct deposited into his account like a paycheck. Explaining how the client would get a paycheck-like deposit twice a month was really all the client wanted to hear. “What we appreciate as advisors is not always what our clients appreciate,” he says.

- Prioritize simplicity everywhere.

Complexity can quickly invade a practice, unless guarded against. Brown strives for simplicity differently with clients and employees.

With clients: Clients will periodically approach Brown with new investment products to consider — for instance, complex annuities. Brown will look at the materials and use them as an opportunity to highlight to the client how complicated these products are in their attempt to manage risk while producing return. In contrast, he can clearly articulate in simple terms how an investment portfolio selected for the client aims to maximize return for the level of risk appropriate for them.

“I’ve been in this business for a long time and even I don’t understand some of these products,” he says.

The same goes when clients try to push advisors to time the market. These are also opportunities to remind clients that the advisor’s job is to help build the best possible portfolio to endure most market conditions.

“When things get tough, it’s very common that the consumer wants to look for a solution,” he says. “We just have to go back to what’s worked for many, many years and stick to a strategy.”

With employees: Make sure employees, from the support advisors to staff, understand the firm’s role is to keep clients on the path to reach their long-term financial goals. Everyone should communicate the “same message that we’re here to take care of you or help you through your retirement,” he says.

Genovese periodically polls clients to make sure the firm’s roughly 30 employees are keeping things understandable, which is valuable feedback. “There’s been some times where our clients have given us feedback and urged us to cut down on the jargon,” he says.

- Concentrate on a few, flexible model portfolios.

Avoid the temptation to build custom portfolios for every client. Most clients’ goals aren’t that unique, and staying focused on a finite group of model portfolios allows you to manage them more effectively, especially during periods of market stress.

What Genovese Burford & Brothers does

Genovese Burford & Brothers offers seven model portfolios and finds all its clients will fit into one of them. “Most clients aren’t that unique and different in that they need to have an eighth or ninth model portfolio,” he says. “The moment you start to deviate away from model portfolios and create something custom for your clients, you add complexity to your life,” he says.

Limiting model portfolios, for instance, allows RIAs to react accordingly during periods of market volatility. Genovese Burford & Brothers’ model portfolios are built with traditional asset classes: equities, fixed income and increasingly alternative investments that are less correlated with other asset classes.

Genovese Burford & Brothers’ investment committee meets twice a month and can efficiently monitor the suite of seven portfolios.

The firm is looking to conservatively expand alternatives, looking for asset classes that do not move in lockstep with stocks and bonds. Currently, alternatives are 10% of many portfolios. But even with alternatives, Genovese Burford & Brothers focuses only on those that make sense to them. “If we can’t understand it, we don’t want to own it,” Brown says.

It’s all about goals and keeping the path there as simple as possible for clients. “It’s not so much how they get there, it’s more of a matter of ‘Am I going to get there?’”

Video

A Client’s Simple Request

Alex Brown:

Well, w- w- we fight it, believe it or not, because the industry's pushing us to become more complicated. We have to continually introduce new products and new ideas, when the reality is, at the end of the day, all our clients want to know is, are they okay, can they retire? You know? I mean, I, I sat in a room with a client, and I was going through our investment process, and I was walking through them all the things that we do, and at the end of the day, they stopped and said, "Hey, all I want to know is, am I going to be able to retire?" And I said, "That's really... That's very important, right?" Um, and so, it made me think about what really is important for the client. And I found out that it's, it's not that complicated.

RELATED INSIGHTS

-

-

Traits of Top Advisors

-

Practice Management

Use of this website is intended for U.S. residents only.

Alex Brown

Alex Brown