Bonds

The U.S. economy has been growing at the strongest rate in decades, the stock market has reached new highs and bond values have been soaring. Does it get any better than this?

Well, it’s complicated. Inflation has climbed to a 30-year high. That — combined with an improving labor market — is pushing the Federal Reserve toward interest rate hikes, which could impact both taxable and municipal bonds. Stellar growth is also expected to slow steadily in coming quarters. And while we appear to see the light at the end of the COVID tunnel, new variants remain a persistent threat.

Given these conflicting signals, a balanced approach to fixed income investing might be best. That means anchoring your portfolio with high-quality bond funds that can provide diversification, while also selectively allocating to flexible income-focused bond strategies.

Macro picture: Slower economic growth amid rising interest rates

The U.S. economic outlook is fairly strong. Bloomberg’s consensus estimate for GDP growth in 2021 is an impressive 5.7%. Although most economists see positive economic growth continuing over the next few years, they expect it to slow. By 2023, the growth rate could fall to half 2021’s rate. The international outlook is similar, particularly for the eurozone and emerging markets. China’s growth looks potentially worse, with significant risk of a negative surprise to already lackluster projections.

Inflation rose sharply in 2021. Initially, it appeared transitory, caused by short-term supply chain issues and other temporary factors. But in the late part of the year, some “stickier” components began seeing elevated levels of inflation too.

“Backlogs and supply pressures, which had been a driver of inflation, are starting to improve,” explains Ritchie Tuazon, principal investment officer of American Funds Strategic Bond FundSM. “But inflation is now showing up across stickier categories. Rising shelter costs, which includes rents, is one example.”

Central bankers have begun to take inflation more seriously, as well. “In August at the Fed’s annual Jackson Hole conference, Chair Jerome Powell laid out five reasons for the Fed’s thinking on why inflation is transitory,” Tuazon says. “Since that time, arguably all five of those factors have moved against this view. As a result, we have started to see some softening of the Fed’s initial conviction of transitory inflation.

“That said, I don’t expect the Fed to begin hiking rates before its asset taper program has concluded,” Tuazon continues. “But should inflation continue to look less transitory, the Fed could begin hiking rates immediately once the taper is complete.”

Given a 50-year-low jobless claims reading in November and an unemployment rate near 4%, the labor market no longer looks to be standing in the Fed’s way. In fact, labor shortages may be driving up wages and contributing to inflation.

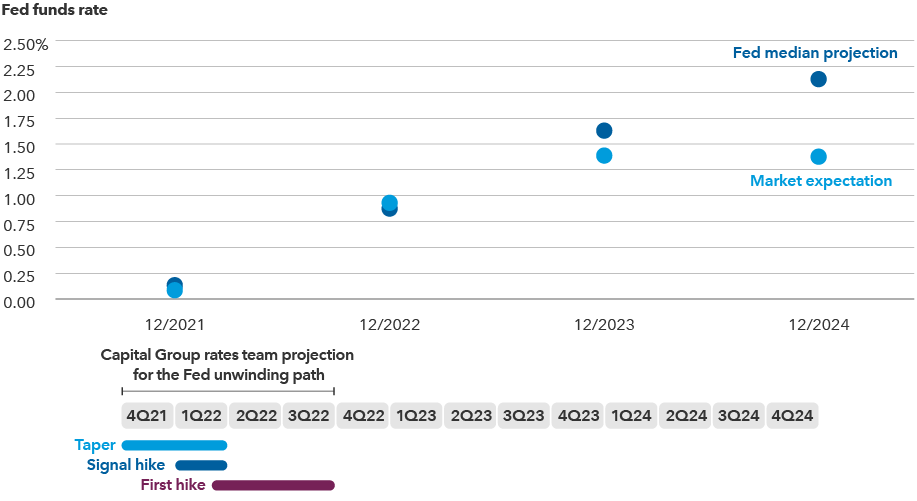

Rate hike expectations have risen due to high inflation and a healthy labor market

Sources: Capital Group, Bloomberg, Federal Reserve. As of 12/15/21. Market expectations based on futures pricing. Midpoint of the federal funds target rates is shown.

Rising interest rates don’t always sink bond markets

Theoretical bond math shows that when rates rise, bond values decline. But reality isn’t so simple.

“The Fed only directly controls short-term rates,” Tuazon says. “That means rate hikes should have an outsized impact on shorter maturity bonds. Put another way, the shorter term part of the Treasury yield curve should rise more than the longer term. This would indicate a flattening of the yield curve, which tends to happen when the Fed tightens policy.”

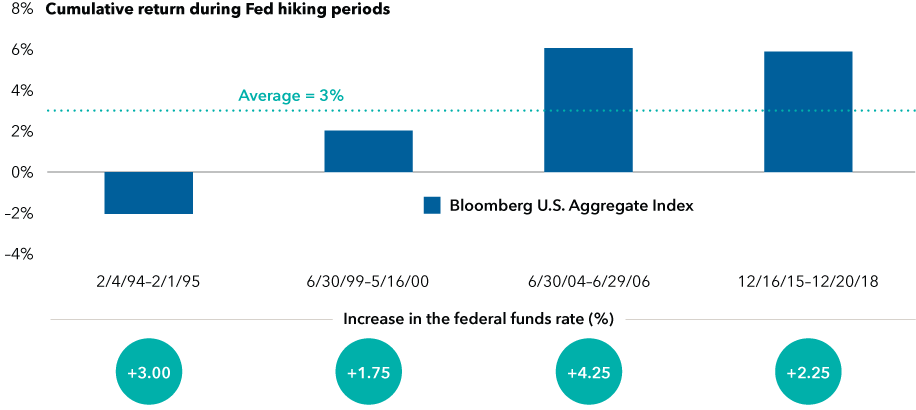

Bonds of varying maturities see different effects from rate increases. Consider the last four periods of hikes. The Bloomberg U.S. Aggregate Index, the prominent benchmark for core bond funds that features a mix of high-quality issues across sectors and maturities, has only had a negative return once, while the average return over those periods was 3%.

The core bond benchmark has fared relatively well in recent periods of rate hikes

Sources: Bloomberg Index Services Ltd., Morningstar. As of 11/30/21.

Selectivity matters. “Actively managed bond funds can position portfolios to focus on certain parts of the yield curve,” Tuazon explains. “We can avoid bonds that we believe will be more adversely affected by rising rates. We can also aim to mitigate inflation risk by purchasing Treasury Inflation-Protected Securities (TIPS).” TIPS are linked to the Consumer Price Index, so they have the potential to outpace nominal Treasuries in periods of rising inflation.

Amid steep asset prices, be selective and flexible

“With many assets priced at expensive levels, some sectors and issuers may present more value opportunities than others in the months to come,” says Damien McCann, principal investment officer of American Funds Multi-Sector Income FundSM.

“Both investment-grade (rated BBB and higher) and high-yield (rated BB and lower) corporate spread levels look very expensive on a historical basis,” McCann continues. Spreads are the risk premium investors receive when taking on credit risk compared to Treasuries. “But other factors also matter.”

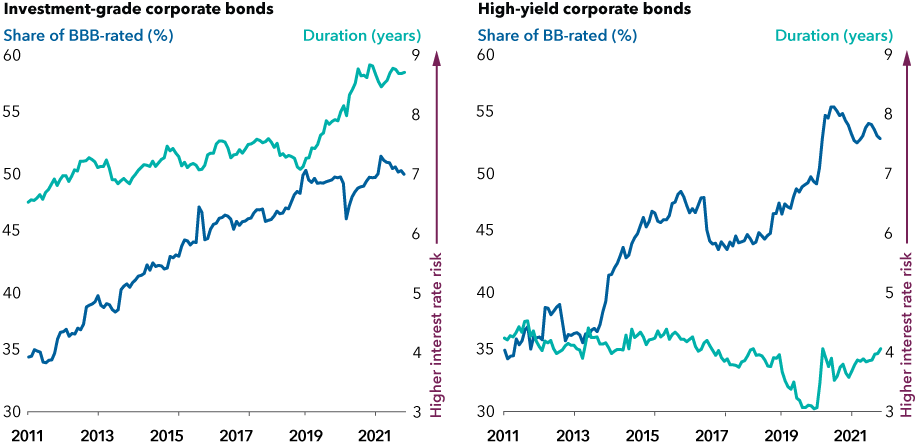

Credit and interest rate risks have been rising for investment grade and falling for high yield

Source: Bloomberg. As of 11/30/21. BBB-rated bonds are the lowest rated tier in the investment-grade corporate bond market, represented by the Bloomberg U.S. Corporate Investment Grade Index. BB-rated bonds are the highest rated tier in the high-yield corporate bond market, represented by the Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index. Duration is a measure of the sensitivity of the price of a bond to a change in interest rates.

Credit quality, for example, has been declining for investment-grade corporates. The sector has seen a rising share of its BBB-rated bonds. Meanwhile, credit quality for high-yield corporates has been improving, with its share of BB-rated bonds climbing as well. Similarly, interest rate risk, as measured by duration, has been increasing for investment-grade bonds. Roughly speaking, the higher the duration, the more risk rising interest rates pose. That could be a notable factor at a time when rates look poised to rise.

“Flexibility is important here,” McCann adds. “With so much uncertainty, now is probably not the best time to be all-in on a specific sector or asset class. As markets and our information evolve, so too will the best areas in which to invest.”

This is an advantage for bond funds that take a multisector approach, as opposed to those with a singular source of income that may not hold up well as the economic picture changes. “We will search across sectors from corporate bonds to emerging markets debt to securitized bonds,” McCann continues. “Our approach seeks to pivot quickly not only between sectors based on changing macro viewpoints, but also from security to security based on new research and convictions.”

Good muni fundamentals, but research reveals relative value

Like with taxable bonds, selectivity within municipal bonds is essential. History has shown that periods of Fed rate hikes are not necessarily negative for munis. Broader bond yields can have a more significant impact. But how muni issuers will fare also depends on a multitude of factors, from potential tax policy changes to the recent U.S. infrastructure package.

“Munis are in pretty good shape from a fundamental standpoint,” says Courtney Wolf, a portfolio manager for The Tax-Exempt Bond Fund of America®. “State and local governments, and other revenue bond sectors have really benefited from COVID-related stimulus. There’s still some money there to spend.

“I’m looking for subsectors and securities that will provide strong relative value,” Wolf adds. “For example, I view many generic BBB-rated munis as expensive. Our research indicates there may be higher quality A- or AA-rated bonds from some issuers that could provide as much potential return as BBBs.”

Investment implications: Balance and selectivity

Given current trends and underlying uncertainty, consider the following actions when investing in fixed income.

- Amid inflation, rethink cash. Investors have $4.5 trillion in money market funds. With negligible yield amid elevated inflation, holding these assets may have a negative impact on purchasing power. High-quality short-term bond funds have the potential to provide more income. Look for a strong track record of capital preservation.

- Stay strong at the core. Assets are priced at expensive levels. Meanwhile, growth is expected to slow, and risks are expected to persist. Diversification remains important. Funds that seek to avoid interest rate risk and protect from inflation may be especially noteworthy.

- Be selective about income. As global markets move toward a new normal, some bonds and sectors will fare better than others. Research-driven management has the potential to pursue better opportunities.

- Consider the after-tax benefits of municipals. With strong fundamentals, muni bonds may remain a good value for investors in higher tax brackets.

The 2022 outlook is cautiously positive, but not without risks. Consider maintaining a balanced portfolio with fixed income that can provide diversification and a measure of income.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds. Income from municipal bonds may be subject to state or local income taxes and/or the federal alternative minimum tax. Certain other income, as well as capital gain distributions, may be taxable. The use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional cash securities, such as stocks and bonds.

Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor's, Moody's and/or Fitch, as an indication of an issuer's creditworthiness.

American Funds Strategic Bond Fund may engage in frequent and active trading of its portfolio securities, which may involve correspondingly greater transaction costs, adversely affecting the fund’s results.

Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. Bloomberg U.S. Corporate Investment Grade Index represents the universe of investment grade, publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity and quality requirements. Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index covers the universe of fixed-rate, non-investment-grade debt. The index limits the maximum exposure of any one issuer to 2%.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

©2021 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

For financial professionals only. Not for use with the public.

Ritchie Tuazon

Ritchie Tuazon

Damien McCann

Damien McCann

Courtney Wolf

Courtney Wolf