The IRS increased the allowable gift tax exclusion amounts for 2024, which could offer additional gift giving opportunities. For example, contributions to 529 plans qualify for the annual gift tax exclusion. There is still time to make the most of this provision before year’s end.

Insights

Insights

Wealth Planning

As 2024 draws to a close, it’s a good time to prepare your finances for the coming 12 months. That’s good advice every year, but especially so today.

In addition to perennial end-of-the-year wealth planning maneuvers, there’s an added twist on the horizon that is expected to have a big impact on high net worth taxpayers.

Elements of the 2017 Tax Cuts and Jobs Act, which established broadly lower rates for individuals and families, are set to sunset on Jan. 1, 2026. Unless Congress chooses to extend or modify the current rates ahead of the expiration date, income tax rates will revert to the higher levels that existed prior to the TCJA, while gift and estate tax exemption limits will be cut significantly.

A lot hinges on the outcome of the U.S. election and how Congress proceeds on this issue. But while it’s too early to pinpoint what comes next, it’s not too early to review your planning and think through your strategy with your Private Wealth Advisor. Though the sunset date may seem far off, acting early provides time to carefully think through and implement any changes to your plan.

Here is a look at these and other year-end planning steps to consider:

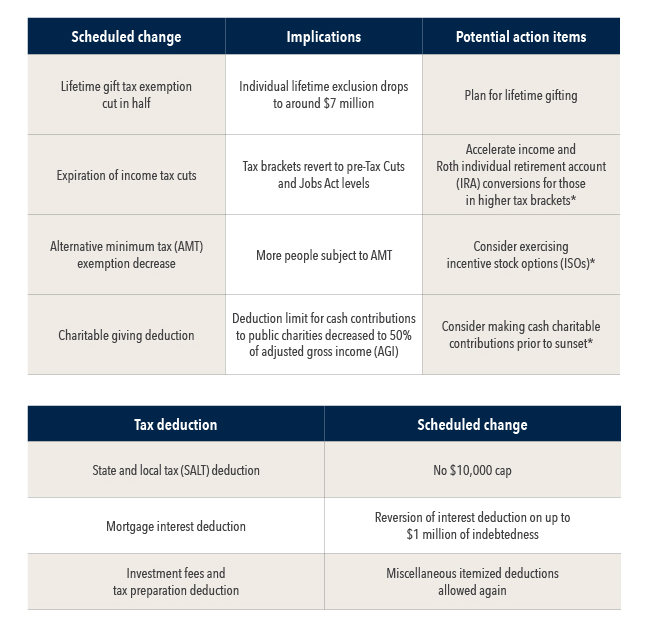

There are many potential tax changes on the horizon, but several are particularly notable for wealthier taxpayers:

- The lifetime gift tax exemption amount may be cut in half

- Income tax cuts are scheduled to expire

- A decreased alternative minimum tax exemption (AMT)

- A lower tax deduction for charitable contributions

This could significantly impact your future estate tax liability. You can find more details and read what our Trust and Estate specialists say about these expected changes here. Your Private Wealth Advisor, in conjunction with your certified public accountant, can help you determine actions to consider now under today’s potentially more expansive rules.

Scheduled tax changes for 2026

Source: Capital Group Private Client Services. This material does not constitute legal or tax advice. Investors should consult with their legal or tax advisors. *Consult with your certified personal accountant (CPA).

It’s important to note that there are some changes to retirement accounts that will take effect in 2025. We would like to highlight a couple of them.

One change is that employees between the ages of 60 and 63 will have a higher catch-up limit for employer plans. Also on the horizon are new rules for inherited retirement accounts. Recently issued final required minimum distribution (RMD) regulations confirmed that if an account owner had already begun taking RMDs, a beneficiary subject to the 10-year rule must continue taking annual distributions each year. These accounts must still be emptied by the end of year ten.

We’ll help you meet your annual obligations and take advantage of opportunities.

It’s easy to lose track of the little details in investing, especially if you have complex holdings. Each year, we help our clients think through and complete several tasks, including making gifts and maximizing annual contributions to retirement accounts.

This is also a good time of year to review your assets to evaluate that it is still in line with your objectives. As part of your year-end review, please discuss with your Private Wealth Advisor if you have any reasonable restrictions you would like to add or change in the management of your account.

We often advise clients to contribute the maximum allowable amount to retirement plans such as 401(k) accounts. Your Private Wealth Advisor can help review what you’ve already contributed and whether you can or should add more to these accounts based on your individual circumstances.

You may also have some distribution obligations. If you are 73 or older, you must make RMDs from non-Roth retirement accounts. If you have such accounts with Capital Group Private Client Services, your Private Wealth Advisor and team can confirm your required distribution amount and help you implement the distribution.

Clients might also consider converting tax-deferred assets to a Roth account. Your Private Wealth Advisor can work with you and your tax advisor to help determine whether it would be beneficial for you.

You still have time to make charitable gifts for 2024. Your Private Wealth Advisor can provide strategies and opportunities to consider to make your generosity work harder for the recipients — and for you. Not only are there ways to make a gift go further for the organizations and causes close to your heart, but certain strategies can also result in greater tax efficiencies for you.

Additionally, you might be able to better utilize gifts to loved ones. Giving during your life can result in more wealth flowing to your loved ones overall, depending on your individual situation. We can review your opportunities for gifts, such as covering tuition or medical expenses or making better use of your annual and lifetime estate tax exclusion amounts.

We also recommend checking on your estate plan. Your Private Wealth Advisor and team can examine its associated documents to help you determine if they are still aligned with your goals and objectives, including:

- Checking that your gift plan and named fiduciaries reflect your current family situation and wishes

- Identify tax planning strategies that may be relevant to your estate plan

- Determine if your current life insurance benefits meet your needs

- Review and update beneficiary designations

Funding a child’s education — even if it’s years away — offers another opportunity. Special 529 accounts allow for tax advantaged treatment when savings are used for qualified education expenses. State tax treatment varies. These accounts have their own rules for giving, such as the ability to pre-fund up to five years’ worth of giving at once without gift-tax consequences.

Note that when accelerating five years' worth of contributions, additional gifts made to that beneficiary after the year in which the one-time gift is made may reduce the donor’s lifetime gift and estate tax exemption. If the donor of an accelerated gift dies within the five-year period, a portion of the transferred amount will be included in the donor’s estate for tax purposes. Consult with a tax advisor regarding your specific situation.

Please reach out to your Private Wealth Advisor if you have questions on any of these topics.

Capital Group Private Client Services does not provide legal or tax advice. For estate planning or taxation matters, investors should consult with a legal and/or tax advisor regarding their individual circumstances.

Tara Rich

Tara Rich