Tax & Estate Planning

U.S. Equities

In the frantic buzz of the California Gold Rush, thousands of hopeful miners descended on the Sierra Nevada mountains with little more than pickaxes and pans. But those who reaped the greatest riches didn’t necessarily strike gold. Most fortunes were made by the merchants who sold essential supplies to the miners: denim work pants, picks, shovels.

What looked like humble businesses often turned out to be money-making machines. After all, every miner — successful or not — needed equipment.

This history provides a powerful lesson for investors today: While high-profile companies at the forefront of emerging industries garner outsize attention and breathless headlines, great opportunities also can be found among the suppliers of the underlying tools and infrastructure.

This “pick-and-shovel” approach focuses on essential suppliers and support businesses that are expected to benefit regardless of the ultimate fortunes of any single company. By investing in underlying component makers and service providers, I believe that investors can capitalize on emerging growth trends while managing the risk of investing in an individual company.

The pick-and-shovel approach stretches across industries.

Consider the weight loss drug business. Surging demand for glucagon-like peptide-1 (GLP-1) weight loss medications has been a boon for pharmaceutical companies. It has also created opportunities further down the supply chain. Businesses involved in manufacturing these drugs, producing the reagents used in labs and making the injection pens needed for drug administration all stand to benefit.

The situation is similar in aviation. Air travel continues to rebound following the pandemic. Global traffic for 2023 reached 94.1 percent of its pre-pandemic level and further growth is projected this year, according to the International Air Transport Association. That not only creates opportunities for airplane manufacturers, but also for parts makers, logistics handlers and service providers. Once an engine is on an airplane wing, it will need repairs and maintenance for decades.

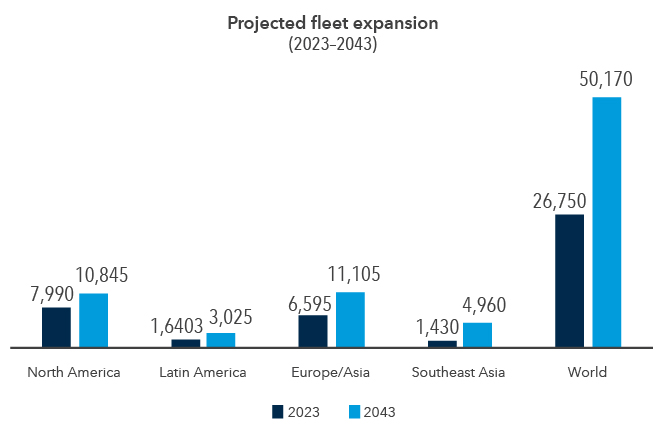

As more people travel, fleets are projected to grow, feeding through to aircraft and parts manufacturers

Source: Boeing Commercial Market Outlook. Data for 2043 is a projection. As of July 2024.

Additional examples come from the burgeoning artificial intelligence (AI) sector. AI holds vast potential, especially the relative handful of companies designing chips for advanced tasks. Look no further than chipmaker Nvidia, which briefly became the most valuable publicly traded company earlier this year. Nevertheless, the market is competitive and it’s unclear which businesses may dominate in the long term.

Some variables in the AI ecosystem, though, are more fixed. For instance, the major chipmakers need to work with semiconductor foundries, chip design services and the suppliers of the equipment used to make cutting-edge semiconductors. Take, for example, the Dutch photolithography systems supplier ASML, which produces highly advanced chipmaking machinery, or Taiwan Semiconductor Manufacturing Co., which fabricates advanced chips for key players including Nvidia and Apple.

The swell of infrastructure development across the U.S. — what my colleague Anne-Marie Peterson has called a new industrial revolution — also presents opportunities for pick-and-shovel investing. After a nearly two-decade period of stagnation, electricity demand is on the rise, fueled by energy-intensive data centers, electric vehicles and the AI industry. This, coupled with government incentives for clean energy infrastructure development, has spurred a surge of new construction projects to upgrade energy systems and modernize the grid.

Many sectors are poised to benefit from this buildout. For example, the power management company Eaton reported record second-quarter earnings and projected stronger-than-expected growth for data centers from tech giants including Amazon.com and Google. Additionally, Dominion Energy is constructing a $9.8 billion wind farm off the coast of Virginia, which would become the largest in the U.S. Materials manufacturers and transportation & logistics services could also see trickle-down effects.

Selecting pick-and-shovel companies requires deep research.

Pick-and-shovel investing requires rigorous research and a comprehensive understanding of an entire industry because success hinges on identifying companies that truly underpin a sector’s growth. A research-backed approach is also necessary to anticipate shifts in demand. Changes in technology, market needs or regulations can impact which pick-and-shovel operators thrive.

Sectors with high barriers to entry, which can offer some protection against new competitors entering the market, can present some of the most attractive pick-and-shovel opportunities.

Barriers can include government regulation, capital requirements and specialized knowledge or technology. For example, the aviation industry has substantial regulatory hurdles. In the U.S., the Federal Aviation Administration (FAA) oversees the approval of aircraft parts and manufacturers, making it difficult for new suppliers to enter the market quickly. In other words, competition can’t spring out of nowhere.

In the pharmaceutical industry Food and Drug Administration (FDA) regulations create impediments. And in the semiconductor business, the substantial capital required for advanced manufacturing limits potential competitors. These regulatory and financial moats help protect established players, enhancing their potential appeal.

Incorporating pick-and-shovel businesses into a diversified portfolio can allow investors to benefit from broad trends while helping to maintain balanced risk profiles. Picks and shovels can be a valuable component of a well-rounded investment strategy, helping to provide some long-term stability and growth potential.

Related Insights

Related Insights

-

-

Philanthropy

-

Wealth Planning

Jody Jonsson

Jody Jonsson