Economic Indicators

Portfolio Construction

When stocks zig, bonds are supposed to zag. That time-honored relationship broke down over the past few years, but there are encouraging signs of its eventual return.

While stocks perked near the end of 2023 on news that the Federal Reserve might be done with interest rate hikes, there’s no doubt that the last couple of years have been challenging for fixed income. Losses in 2022 were particularly steep. It marked the first year in decades that bonds fell alongside stocks. Rapid rate increases by the Federal Reserve, against a backdrop of some of the highest inflation rates the U.S. economy has experienced in more than 40 years, caused massive upheaval. The chart to the right, depicting the correlation between stocks and bonds during equity correction periods since 2010, shows just how unusual a period it was.

Unlike other recent equity corrections, bonds buckled alongside equities in 2022

Source: Morningstar. As of October 31, 2023. Correlation is a statistic that measures the degree to which two variables move in relation to each other; a positive correlation implies that they move together in the same direction while a negative correlation implies that they move in opposite directions. Correlation figures based on returns data for the S&P 500 Index versus the Bloomberg U.S. Aggregate Index. Correlation shown for the eight equity market correction periods since 2010. Corrections are based on price declines of 10% or more (without dividends reinvested) in the unmanaged S&P 500 with at least 75% recovery. Dates for correction periods are as follows: Flash crash, April 2010 to July 2010. U.S. debt downgrade: April 2011 to October 2011. China slowdown: May 2015 to August 2015. Oil price shock: November 2015 to February 2016. U.S. inflation/rate scare: January 2018 to February 2018. Global selloff: September 2018 to December 2018. COVID-19 pandemic: February 2020 to March 2020. Historic inflation and rate hikes: January 2022 to October 2022. Past results are not predictive of results in future periods.

But as those rate hikes recede into the rearview mirror and markets focus on the growth backdrop, fixed income may resume its role as a ballast in portfolios. In addition, higher starting yields mean higher return potential for bonds.

“This Fed hiking cycle has been the quickest that we’ve seen in decades, and it’s likely we’ll see interest rate sensitive segments of the economy soon experience challenges as a result,” says Chitrang Purani, a Capital Group fixed income portfolio manager. “Economic weakening should generally be positive for bonds, both from the standpoint of absolute returns and diversification from equities.”

The Fed’s actions have continued to loom large. After raising rates by a total of 1 percentage point in 2023, it signaled in December that it was mulling potential cuts this year, as inflation — though still elevated — had fallen significantly from its recent highs. Meanwhile, a much more resilient U.S. economy has led to continued shifts in expectations for not just the federal funds rate but for interest rates across the maturity spectrum. A robust labor market, high pandemic-era savings and government stimulus are among the factors behind the economy’s resilience.

Bond investors might be able to breathe easy again.

The Fed opted to skip rate hikes for its last three meetings of 2023 and projected up to three potential cuts this year. Fed Chair Jerome Powell cautioned that this is a forecast, subject to change if conditions shift. Still, these are strong signals that the Fed is likely done, or close to done, with its hiking cycle.

Resilient growth and still elevated inflation have adjusted the Fed’s rate expectations

Source: Federal Reserve. As of November 13, 2023. Year-end projections pulled from Federal Open Market Committee statements released on December 14, 2022; March 22, 2023; June 14, 2023; September 20, 2023. Fed funds rate shown is the upper limit of the fed funds rate.

“It’s been easier for inflation to fall from peak levels to near 3% than it will be to see it come back down to the Fed’s 2% target,” Purani says. “Given growth has been more resilient than most expected, interest rates are likely to remain ‘higher for longer,’ and that’s been reflected in the market in 2023.”

The higher-for-longer view anticipates that rates, while potentially shifting a little up or down, may stay at elevated levels for an extended period.

The additional repricing of interest rates higher in 2023 has created a more favorable risk/return balance for fixed income relative to the end of 2022. Returns are being aided by relatively strong starting yields, which recently touched a roughly 16-year high on the Bloomberg U.S. Aggregate Index.

“After the end of previous Fed hiking cycles, bonds have typically posted strong returns in the subsequent 12 months from a total return standpoint,” Purani explains. “That’s historically been a good time to buy into fixed income.” Higher starting yields on their own may support an attractive return profile, but bonds have the potential to diversify against equity volatility with even stronger returns should economic growth materially deteriorate.

Some investors have been questioning the value of rebuilding a fixed income allocation after bonds fell alongside stocks in 2022. Historically, core bonds haven’t moved in tandem with stocks, but that relationship was strained against the backdrop of sharply accelerating inflation and shifting monetary policy. However, a more benign outlook for inflation may enhance diversification going forward.

“When inflation is both high and rising, correlations tend to increase between bonds and equities,” Purani adds. “As inflation stabilizes or falls, bonds may act as a more reliable diversifier against equity weakness, even if inflation remains at somewhat more elevated levels than in the past decade.”

Core bonds appear attractive.

Purani believes the risk of interest rate exposure in portfolios is better balanced. Duration, which measures a bond fund’s sensitivity to interest rates, could shift from a headwind to a tailwind for bond returns over this year if rates are near their peak. Investors with a higher allocation to equities or other risky assets may want to increase their duration exposure, given better compensation today for rates exposure and the potential for price appreciation should the Fed cut rates in response to an economic downturn. Core bond funds may be a good option in this respect, assuming they don’t stray too far down the risk spectrum to chase higher yields, Purani adds.

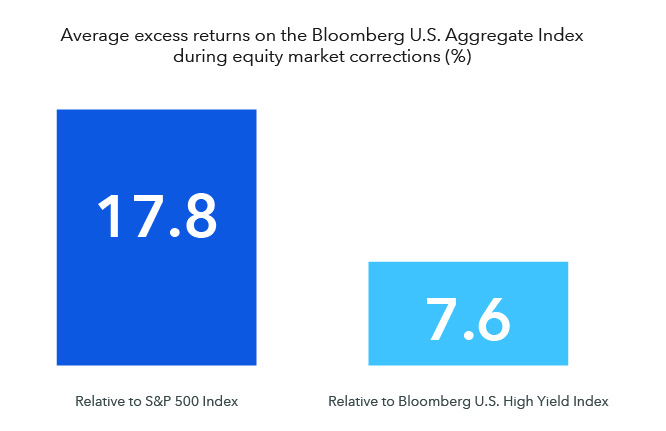

The core bond benchmark outpaced stocks and riskier bonds amid equity turmoil

Source: Morningstar. Averages were calculated by using the cumulative returns of the Bloomberg U.S. Aggregate Index versus the S&P 500 Index and the Bloomberg U.S. High Yield 2% Issuer Capped Index during the eight equity market correction periods since 2010. Corrections are based on price declines of 10% or more (without dividends reinvested) in the unmanaged S&P 500 Index with at least 75% recovery. The cumulative returns are based on total returns. Ranges of returns for the equity corrections measured: Bloomberg U.S. Aggregate Index: –14.38% to 5.35%; S&P 500 Index: –10.1% to –33.79%; Bloomberg U.S. High Yield 2% Issuer Capped Index: –20.76% to –1.45%. There have been periods when the Bloomberg U.S. Aggregate Index has lagged the other indices, such as in rising equity markets. Past results are not predictive of results in future periods. The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. As of October 31, 2023.

The outlook is constructive.

After a long slump, bonds may finally be poised to resume their role as equity diversifiers in investor portfolios. Inflation is trending down. Concerns over reinflation appear to be moderating. The policy rate may be near — if not at — the peak. These factors all bode well for the risk/return prospects for bonds.

Investors looking to add balance through fixed income should consider a fund’s exposure to high-quality holdings and duration. A proven long-term track record of strong relative returns in down equity markets is also essential, though past results are not predictive of results in future periods.

“Nobody can have certainty in today’s outlook,” Purani concludes. “But over the next 12 months, high-quality fixed income has the potential to provide attractive opportunities from both a yield and total return standpoint, supporting its traditional role as a ballast within diversified portfolios.”

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market.

Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index covers the universe of fixed-rate, non-investment-grade debt. The index limits the maximum exposure of any one issuer to 2%.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds.

Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor's, Moody's and/or Fitch, as an indication of an issuer's creditworthiness.

Duration indicates a bond fund’s sensitivity to interest rates. Higher duration indicates more sensitivity.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

©2023 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.