Global Equities

Markets & Research

Whether it’s business, government, tobacco or almost anything else, if you plant “big” in front of an otherwise ordinary word, the resulting phrase takes on an ominous tone. It starts to connote unchecked power and even sinister intent. That’s become the case with Big Tech. The largest U.S. technology companies were once lionized as exemplars of American ingenuity. Now they’re under a microscope, fending off criticism about their market concentration, impact on personal privacy and effect on politics.

State and federal authorities are pursuing a string of antitrust and regulatory investigations. In October, the Justice Department filed an antitrust suit against Google, the largest since its 1998 action against Microsoft. The Federal Trade Commission sued Facebook in December, saying the social media giant’s acquisitions of Instagram and WhatsApp were anti-competitive. And a number of states are looking to curtail the companies’ reach through new legislation.

To be sure, these companies have a lot going their way. Though it’s unclear how the probes will play out, it’s doubtful that any of the so-called FAANG companies (Facebook, Apple, Amazon, Netflix and Google) will be sliced up. Cases alleging monopolistic practices have historically centered on abusive pricing, a yardstick with far less applicability to businesses that typically don’t charge — at least, not explicitly — for their products.

If anything, the digital giants’ hammerlock on society increased during the coronavirus pandemic, when business relied heavily on video calls while consumers gobbled up streaming video. Five of the top 10 U.S. companies by market capitalization are tech or digital businesses, whose combined market value swelled 54% in the past year to more than $7 trillion.

Still, the near term may entail regulatory risks and general uncertainty as policymakers and investors try to answer a fundamental question: Is it possible to be too successful and influential?

“The sheer size of these technology companies means they’re going to get a lot of scrutiny from every part of society, including government and regulatory agencies,” explains Mark Casey, a Capital Group equity portfolio manager who has covered the tech industry for more than 20 years.

The market is sorting out the regulatory threat.

Scrutiny of the digital behemoths has been building for several years, and it reached a crescendo in the aftermath of the heated presidential election.

“Part of what makes this so complicated is that Democrats have a whole set of issues with these companies — largely based on antitrust, privacy and hate speech concerns — while Republicans have another set of issues, particularly when it comes to the perceived censorship of conservative viewpoints,” Casey notes. “So there’s really no easy scenario where these companies can just make a few changes and everybody’s happy.”

Even without political sensitivity, evaluating regulatory risk for an industry as complex and diverse as information technology is a demanding task, says Brad Barrett, a Capital Group analyst covering ad-supported internet companies. That said, he doesn’t think the antitrust cases against Google and Facebook will result in forced breakups.

Barrett believes the government is facing “an uphill battle” to win these cases, evidenced by the fact that some members of Congress are pushing hard for changes in antitrust law. “That by itself is an admission that it’s difficult to find antitrust violations based on case law going back 20 to 30 years,” he says.

Europe provides a template for the U.S.

Increased regulation is certainly a possibility. If that’s the case, U.S. regulators could seek inspiration from Europe, where authorities have been far more aggressive.

In 2018, the European Union enacted the first major online privacy laws with the General Data Protection Regulation. EU officials have followed up with a series of proposals designed to block certain acquisitions, curb hate speech and provide more information to consumers about how their data is used for targeted advertising.

“Many of these provisions are already being implemented by U.S.-based internet platforms,” Barrett says.

The specter of greater oversight could be weighing on share prices.

The regulatory spotlight could be affecting some stock prices. The two companies facing the most immediate scrutiny, Google parent company Alphabet and Facebook, trade at significantly lower price-to-earnings ratios than some of their peers. In fact, Facebook is trading just above the average P/E for the S&P 500 despite its rapid growth rate and strong free cash flow.

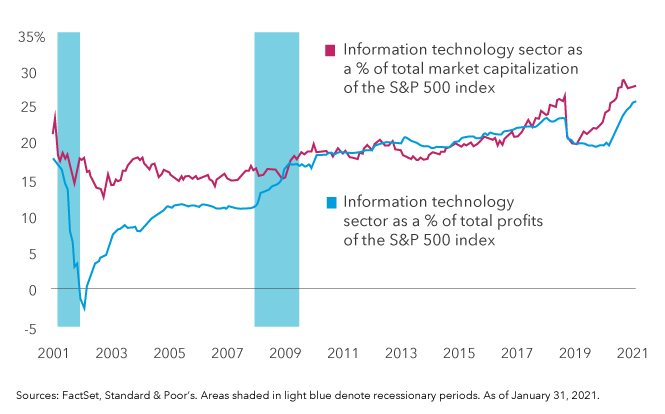

Technology companies are making up a larger slice of the U.S. stock market

“These companies operate in large and growing markets, they have long revenue runways, and they are very profitable,” says Capital Group analyst Tracy Li, who covers internet companies. “If the regulatory risks were not present, in my view, they would be trading at higher multiples.”

Alhough the companies are unlikely to be broken up, even that wouldn’t necessarily be negative for investors. In fact, Li notes that spun-off companies could thrive on their own — a classic example of the parts being worth more than the whole.

WhatsApp, for instance, was acquired by Facebook in 2014. It doesn’t make money. But as a stand-alone entity, it would likely command a high valuation due to its user base of more than 2 billion people in 180 countries and the opportunity to monetize the service in the future.

“The fact that all of these businesses are under one umbrella does tend to obscure the value of each business,” Li says. “As we’ve seen with past antitrust cases, such as the breakup of AT&T and Standard Oil, the results can be quite favorable to shareholders over the long run.”

Related Insights

Related Insights

-

-

U.S. Equities

-

Emerging Markets