Risk factors you should consider before investing:

- This material is not intended to provide investment advice or be considered a personal recommendation.

- The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment.

- Past results are not a guarantee of future results.

- If the currency in which you invest strengthens against the currency in which the underlying investments of the fund are made, the value of your investment will decrease. Currency hedging seeks to limit this, but there is no guarantee that hedging will be totally successful.

- Some portfolios may invest in financial derivative instruments for investment purposes, hedging and/or efficient portfolio management.

- Depending on the strategy, risks may be associated with investing in fixed income, derivatives, emerging markets and/or high-yield securities; emerging markets are volatile and may suffer from liquidity problems.

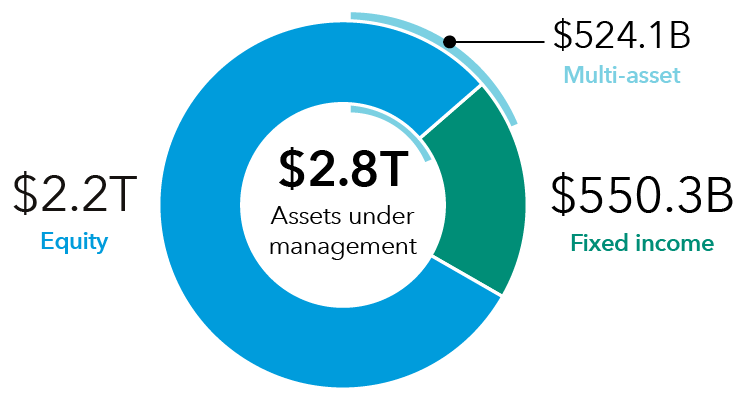

Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organisation; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups. Assets under management totals may not reconcile due to rounding. Fixed income assets managed by Capital Fixed Income Investors