You wouldn’t be human if you didn’t fear loss.

Nobel Prize-winning psychologist Daniel Kahneman demonstrated this with his loss-aversion theory, showing that people feel the pain of losing money more than they enjoy gains. As such, investors’ natural instinct is to flee the market when it starts to plummet, just as greed prompts us to jump back in when stocks are skyrocketing. Both can have negative impacts.

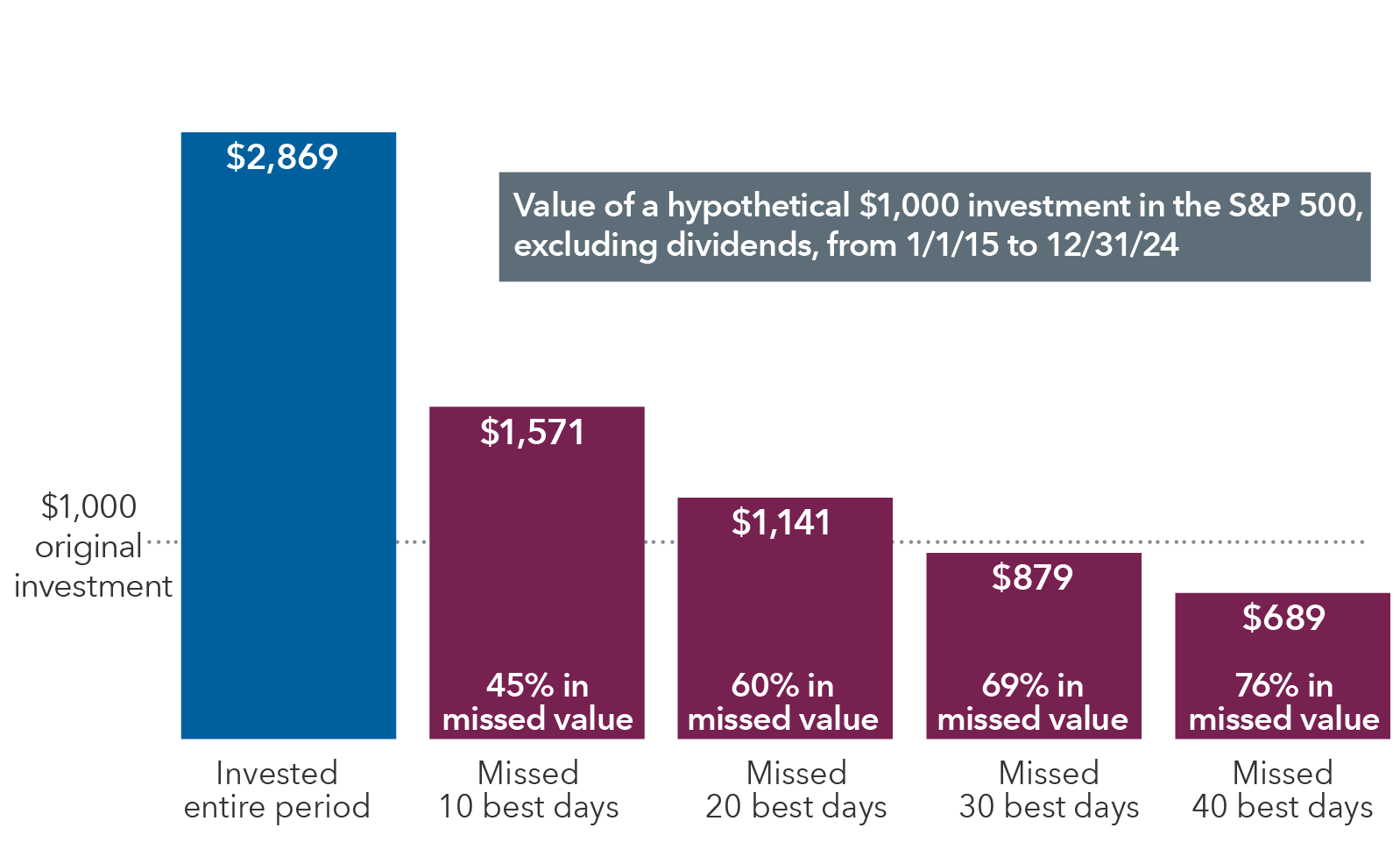

We don’t know what the rest of this year will bring. But smart investing can overcome the power of emotion by focusing on relevant research, solid data and proven strategies. Here are seven principles that can help fight the urge to make emotional decisions in times of market turmoil.

1. Market declines are part of investing

Over long periods of time, stocks have tended to move steadily higher, but history tells us that stock market declines are an inevitable part of investing. The good news is that corrections (defined as a 10% or more decline), bear markets (an extended 20% or more decline) and other challenging patches haven’t lasted forever.