ESG

Our approach to environmental, social and governance (ESG) issues centers on identifying those we believe are material to a company's ability to generate long-term value. The incorporation of material ESG risks and opportunities is aligned with the long-term orientation we have always taken to pursuing superior investment outcomes.

KEY TAKEAWAYS

- Our 25+ sector-specific ESG investment frameworks identify material risks and opportunities we believe will drive long-term value creation.

- We bring our proprietary ESG sector-specific frameworks to life by sourcing 50+ third-party data sources that help us identify opportunities and risks.

- As active managers, we regularly review the topics identified in our frameworks to capture the dynamic nature of ESG issues and ensure they are forward-looking.

At Capital Group, we recognize the need — and value — of integrating material ESG insights into our investment process. This objective is consistent with our longstanding mission to improve people's lives through successful investing.

Our long-term approach, which is a core part of The Capital System™, aligns with the time horizons associated with ESG risks and opportunities. Our equity-focused mutual funds' average holding period is over three years — nearly 75% longer than our peers.** Our deep research, regular dialogue with companies and diversity of thought tend to lead us toward companies focused on creating long-term value. We understand that the enduring profitability and growth of a company are directly tied to its relationships with customers, employees, suppliers, regulators and the environment in which it operates.

Given our long-term approach, many elements of ESG are a natural fit with our investment process and are a focus for our analysts and portfolio managers. We've endeavored to make our approach to ESG integration transparent and evolutionary — with the potential to further adapt over time as the external stakeholder landscape shifts.

We are dedicating significant resources to ESG

As of December 31, 2023..

1The research and investment frameworks were initially developed in 2020.

Our integration of ESG builds on our bottom-up, fundamental research and analysis and is centered on three research and components: research and investment frameworks, a monitoring process, and engagement and proxy voting. We have been intentional about creating a process that reinforces itself, so we can continuously learn.

ESG integration: Our three-part process

* As at 31 December 2023. Monitoring applies to corporate and sovereign holdings

Integrating ESG into The Capital System

The incorporation of material ESG risks and opportunities is deeply woven into The Capital System. Investment decisions are informed by Capital Group’s fundamental, bottom-up research, which includes, where material, analysis of how a company interacts with its community, customers, suppliers and employees. We focus on the ESG issues that directly impact company results and valuations. Our long-term approach, a core part of The Capital System, aligns with the time horizons associated with material ESG risks and opportunities, such as climate change and human capital.

More than 180 of our equity and fixed income investment analysts, in partnership with our dedicated ESG team, collaborate to identify the issues we believe to be material to each sector in our more than 25 ESG investment frameworks. These frameworks help us understand the investment relevance of ESG issues and enable us to measure and assess company performance as part of our investment research.

Importantly, in the frameworks, we are seeking to evaluate the risks and opportunities not fully captured by traditional financial metrics. These issues include long-term secular trends, such as energy transition and human capital. We also consider how companies operate and how they are performing compared to sector peers. For example, can they build a competitive advantage by attracting, retaining and promoting the right people? Are they able to increase consumer trust by providing safer products? Are they able to adapt and transition away from carbon-intensive commodities?

Capital Group is not alone in seeking to understand and measure material ESG issues. Companies, too, are acutely focused on managing these topics and reporting meaningful information to investors. According to the Governance & Accountability Institute, Inc., 98% of S&P 500 Index companies produced a sustainability report in 2022. In addition, more than 1,500 financial institutions, responsible for over US$215 trillion in assets globally, now support Task Force on Climate-Related Financial Disclosures (TCFD) recommendations for climate reporting, according to the Financial Stability Board as of October 2022.‡ In general, we welcome and encourage disclosures aligned to the International Sustainability Standards Board (ISSB), which consolidates a number of the voluntary disclosure frameworks and seeks to help investors better understand the material ESG risks and opportunities facing companies.

Explore the latest research and insights in our ESG perspectives library

Importance of materiality

We know that the definition of what is material is dynamic. It's not uncommon for a seemingly immaterial factor to quickly become material. We view the challenge of determining which issues are material as an opportunity to which we are particularly well-suited, given our focus on deep, fundamental, primary research.

For example, our research suggests human capital is potentially one of the most material and underappreciated drivers of business value.

Spotlight on human capital: A hidden asset of high importance and low transparency

How does a company attract and retain the right talent? What are relations like between employees and management? At first glance, the answers to these questions may not seem as significant as more traditional areas of focus.

At Capital Group, however, we believe that considerations such as workforce skills, working conditions and labour relations can be very important in understanding a firm’s long-term risks and opportunities. "While impact may vary over time and across industries, history shows that human capital has the potential to prompt meaningful value creation and destruction," says ESG analyst Emma Doner in her latest article on the importance of evaluating human capital.

Why human capital is becoming even more crucial

More than half a million US workers staged over 400 strikes in 2023, according to Cornell University's Labour Action Tracker. Labour relations are just one of the many aspects of human capital management that have an impact on companies and issuers today. Tight labour markets, shifting demographics and new regulation suggest human capital is becoming an even more crucial consideration for active investors.

"When evaluating a company's human capital management, there are five key indicators I am looking at," says Emma. "A company's cost of workforce, employee turnover, demographic data, investment in skills and training, as well as culture and engagement — all of which help me understand the material risks and opportunities to the investment case," she adds.Gathering these data points, however, is not always straightforward. Levels of human capital disclosure vary greatly around the globe. That said, there are signs this is beginning to change. Companies and investors alike are closely following regulations such as the U.S. Securities and Exchange Commission (SEC) 2020 rule on human capital disclosure, as well as the European Commission's Corporate Sustainability Reporting Directive (CSRD), which will require companies to disclose certain information relating to workforce policies.

"As investor demands increase and regulations continue to evolve, I expect consistency in reporting will improve over time," says Emma. "Until then, the value of human capital may continue to be undervalued by the rest of the market."

How we measure human capital: Five illuminating indicators

| Indicator | Description |

|---|---|

| Total cost of the workforce | Salaries, wages, bonuses and pension benefits of all employees |

| Employee turnover | Voluntary/involuntary exiting and incoming employee data points |

| Demographic data | Gender, racial, ethnic and other measures of diverse representation across various levels within the firm |

| Skills and training | Total training days, type and costs |

| Culture and engagement | Surveys exploring employees’ attitudes to work for their firms, e.g., purpose, well-being and empowerment |

Proprietary research + third-party data:

A powerful combination

ESG data, when based on quantitative or standardized information, can be valuable input to our investment process. Alongside a robust understanding of material ESG issues, we have found that the information used to measure and evaluate companies matters greatly.

We need to be selective about the ESG data we use. To inform our ESG evaluation process, our analysts leverage data from multiple third-party providers for the monitoring of securities, and to support our investment frameworks in a proprietary in-house tool, Ethos. In some industries, there may be very few valuable third-party data points, thus requiring a heavy reliance on fundamental, bottom-up, analysis or nontraditional data sources. In other sectors, there are several high-quality indicators that can be readily integrated into our investment analysis.

Our singular purpose is to identify companies that are likely to drive sustainable long-term results. Importantly, our investment decisions are made based on a long-term view, engagement and analysis — never solely on monitoring results.

Our ESG research in action

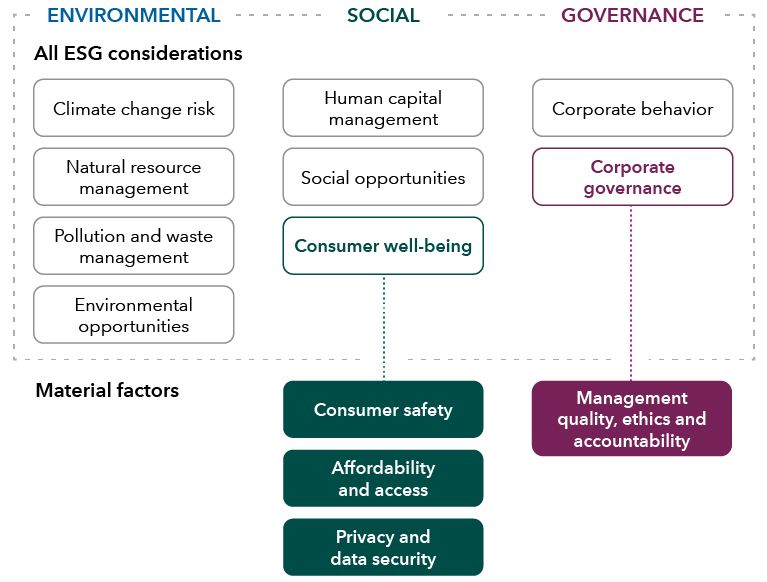

The health care services sector is a good example of our holistic, evidence-based approach to ESG. Capital Group investment analysts identified social issues that pose material ESG risks and opportunities within the industry. This meant a focus on consumer safety and product quality, affordability and access, and data security and privacy, all underpinned by strong management quality and accountability.

Zeroing in on material issues

When evaluating the ESG issues within the U.S. health care services sector, Capital Group analysts sought to identify those they believed were most material to the success of the company as a long-term investment.

In US health care services, one key thesis is that value-based care (e.g., incentives aimed at keeping people healthy rather than additional fees for services) is the most sustainable model over the long term. Doctors in value-based care models tend to conduct more proactive patient outreach and emphasize preventive care and ongoing maintenance. We believe this approach helps raise the health of the broader population and, in turn, likely saves costs and increases patient satisfaction and retention.

To evaluate a company against this investment thesis, analysts conduct primary research through dialogue with the company itself. The analysts ask questions directly to companies at all levels of management, not just the executive suite, which helps them understand if the stated priorities are manifested in the company’s culture and operations. Additionally, our analysts don’t ask just once — or even once a year. It’s an ongoing effort.

Beyond dialogue with companies, our analysts look at nontraditional indicators, such as customer satisfaction tracking and net promoter scores. They also stay on top of new regulations and assess the risk of sanctions, including warning letters, fines, restrictions and recalls.

A differentiated ESG view

Our research efforts, as articulated in our sector-specific investment frameworks, will lead us, at times, to disagree with ESG rating agencies. One major ESG rating agency, for example, rated a company we viewed as a pioneer in value-based care below its peers. The company was penalized for publishing limited information on customer satisfaction rates and not establishing policies on emerging health risks, such as obesity and environmental pollutions. We took a different view — that by changing the incentive structure for doctors, this company encouraged preventative care and contributed to overall better health outcomes, which, in our view, was more material to the company’s long-term success as an organization and as an investment.

An evolving process focused on better outcomes

Because we recognize that material ESG issues can change quickly, we regularly review and adapt the topics identified in our frameworks. We remain convinced that a materiality-based approach to ESG will reinforce the types of sustainable business practices that can drive better results and outcomes for our investors.

* On average, the equity-focused American Funds hold their investments for 4.3 years, whereas their peers hold their investments for 1.9 years, based on the equal-weighted blended averages across each of the 20 equity-focused American Funds' respective Morningstar categories as of December 31, 2022. Fixed income funds are not included in this calculation due to the differing nature of trading in the asset class versus equity investing. American Funds are not registered for sale outside the US.

‡ Governance & Accountability Institute, Inc. (G&A) 2021 Sustainability Reporting in Focus report, focusing on the 2020 publication year. 92% of the S&P 500 companies published a sustainability report in 2020 vs. 20% in 2011.

§ U.S. Bureau of Labor Statistics, April 2021.

‖ Deutsche Bank. “Hospital Trends into 4Q and views around 2022.”

# Berg, Florian, Kölbel, Julian and Rigobon, Roberto. 2022. "Aggregate Confusion: The Divergence of ESG Ratings." MIT Sloan School Working Paper 5822-19, MIT Sloan School of Management, Cambridge, MA.

Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

Our latest insights

-

-

Long-Term Investing

-

Emerging Markets

-

Global Equities

-

Emerging Markets

RELATED INSIGHTS

-

-

Long-Term Investing

-

Emerging Markets

Hear from our investment team.

Sign up now to get industry-leading insights and timely articles delivered to your inbox.

Past results are not predictive of results in future periods. It is not possible to invest directly in an index, which is unmanaged. The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment. This information is not intended to provide investment, tax or other advice, or to be a solicitation to buy or sell any securities.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. All information is as at the date indicated unless otherwise stated. Some information may have been obtained from third parties, and as such the reliability of that information is not guaranteed.

Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

Seema Suchak

Seema Suchak