To many, multi-asset investment may simply mean gaining exposure to a diverse mix of asset classes in one single portfolio. However, at Capital Group, multi-asset investment is much more than just a well-diversified portfolio. By offering you our best-in-class research capability and investment expertise, we are dedicated to providing you a smooth investment journey and robust risk-adjusted results over the long term.

Double layers of diversification

The Capital SystemTM - The power of diversity

At Capital Group, diversification is not only achieved by blending different asset classes together but is also enhanced by the diversity embedded in our distinctive Capital SystemTM.

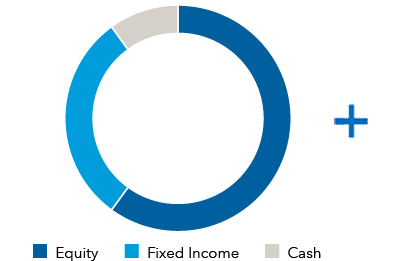

Our multi-asset portfolios are not only invested flexibly across different asset classes, but they are also divided into segments that are managed independently by individual managers via The Capital SystemTM . This time-tested approach does not only offer double layers of diversification but is also designed to attain management continuity and consistent long-term returns for our investors.

The first layer of diversification through dynamic asset allocation

The second layer of diversification through The Capital SystemTM

Segment sizes and the graphic shown are for illustrative purposes only and are not representative of actual portfolio holdings.

“The firm's multimanager system drives its success. Dividing each fund into independently run sleeves lets managers invest in line with their styles, enhancing diversification and reducing the overall portfolio's volatility.”

— Morningstar’s “The Best Fund Companies and their Ratings,” dated 28 January 2020

Extensive research capability

Few firms can match our scale and scope

The extensive scale and scope of our proprietary, collaborative research, built over more than 90 years, enables us to uncover compelling investment opportunities among different asset classes for our clients.

We have an extensive global research team of over 467 investment professionals in 11 research offices around the world, covering both equity and fixed income.

.png)

Collaborative research

Our equity and fixed-income analysts work closely together, pooling research. The blending of the diverse perspectives of these two groups of analysts has enabled us to see ‘both sides of the balance sheet’. Such a process has the potential to deliver compelling investment ideas and gives our portfolio managers a broader, deeper understanding of risk.

“When I meet and research companies, I am looking at everything from both a bond and equity perspective.”

Patricio Ciarfaglia

Portfolio manager

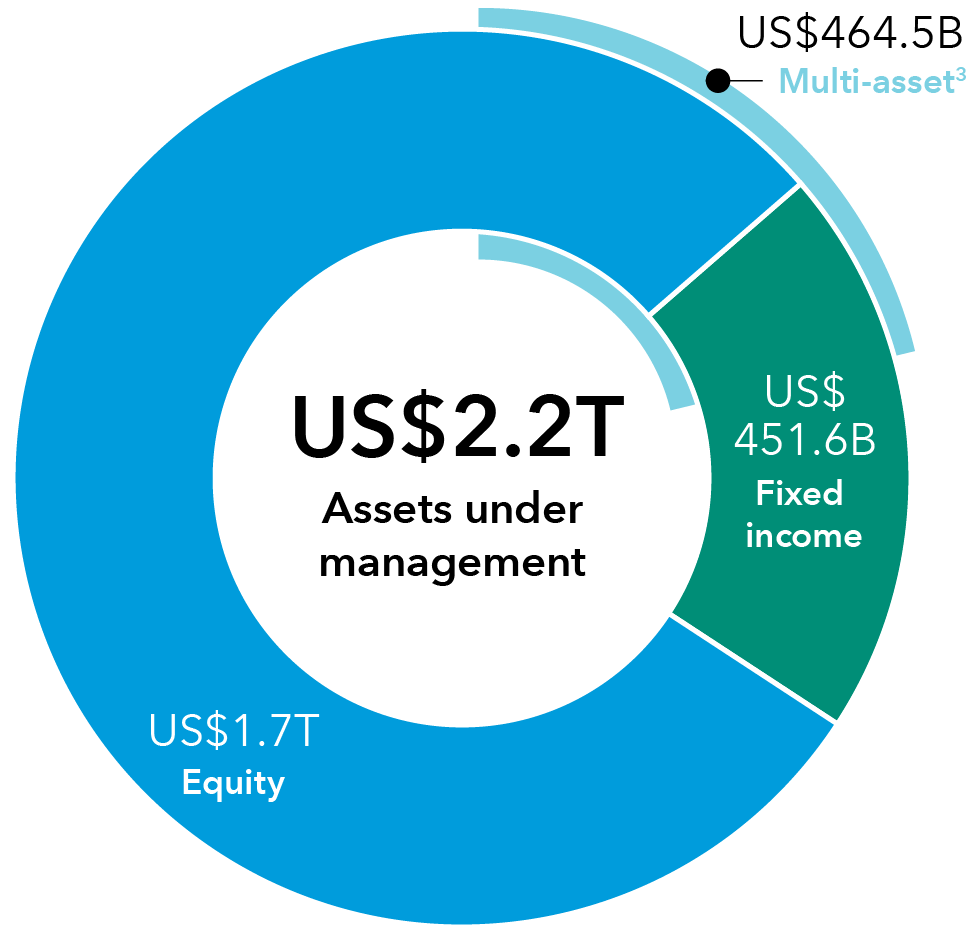

CAPITAL GROUP BY THE NUMBERS

US$479.0 billion3

in multi-asset strategies

1973

Started managing multi-asset strategies

479+

Capital Group investment professionals

27 years

average investment experience of our portfolio managers

Our experience in multi-asset investing dates back more than 45 years when we introduced our first multi-asset mandate in 1973. Since then, we have grown globally and now manage over US$464.8 billion3 in multi-asset investments.

Long-term investment success

Focused on delivering superior, consistent results for long-term investors

Capital Group takes a long-term perspective to align our goals with the interests of clients, which allows us to produce consistently competitive returns for our multi-asset investments.

The combination of our distinctive Capital SystemTM, our integrated research approach, as well as our extensive scale and scope, has been the cornerstone of the consistent, long-term success of our multi-asset strategies.

Strategies available in our Luxembourg fund range

.png)

Past results are not a guarantee of future results. Invested capital is at risk; these strategies aim to achieve a positive return over the long term although there is no guarantee this will be achieved over that or any time period. For illustrative purposes only.

Results are net of management fees and expenses for a representative Luxembourg fund share class (Z). Peer group is defined as the Morningstar category for each strategy. Return statistic is the percentage of Capital Group Luxembourg funds, or strategies where there is an insufficient track record for the analysis, in which the average annual total return exceeded the peer group median. Capital Group strategies in the three-year period: 3 multi-asset; five-year period: 3 multi-asset; and in the eight-year period: 2 multi-asset. There are only 2 multi-asset strategies under the eight-year period but there are 3 multi-asset strategies under the three-year and five-year periods because one of these multi-asset strategies did not exist eight years ago. In the case of investors investing with the help of a distributor or intermediary, Class Z shares would only apply to distributors and intermediaries who are directly compensated by investors through separate fee arrangements. Source: Morningstar

“An investment culture marked by lengthy tenures, strong manager fund ownership, and competitive long-term records.”

— Morningstar’s “Morningstar Global Fund Report”, dated 29 May 2020

Access the best-in-class multi-asset strategies that meet your investment needs

Explore our multi-asset strategies in focus

Capital Group Capital Income Builder strategy

A lower risk solution to capture equity growth potential while maintaining a reliable income stream

Capital Group Emerging Markets Total Opportunities strategy

An unconstrained

ed multi-asset strategy that is designed to capture emerging market equity-like returns with lower volatility

Capital Group Global Allocation strategy

A simple global multi-asset strategy that invests in liquid, high-quality equities and fixed income securities with low correlations

We're here with the support and solutions you need.

Don't hesitate to reach out if you have questions or need assistance.

Past results are not a guarantee of future results.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates.

Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organisation; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups. Assets under management totals may not reconcile due to rounding. Fixed income assets managed by Capital Fixed Income Investors

All data as at 30 June 2022 and attributed to Capital Group (unless otherwise stated).

- Mumbai: Capital Group International, Inc (CGII) only. São Paulo: a private equity office.

- Macroeconomic analysts shown have responsibilities across all asset classes. Number of macroeconomic analysts excludes 7 China industry specialists.

- Represents a proportion of the total equity and fixed income assets

Risk factors you should consider before investing:

- This material is not intended to provide investment advice or be considered a personal recommendation.

- The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment.

- Past results are not a guide to future results.

- Depending on the strategy, risks may be associated with investing in fixed income, emerging markets and/or high-yield securities; emerging markets are volatile and may suffer from liquidity problems.