Capital IdeasTM

Investment insights from Capital Group

Fixed Income

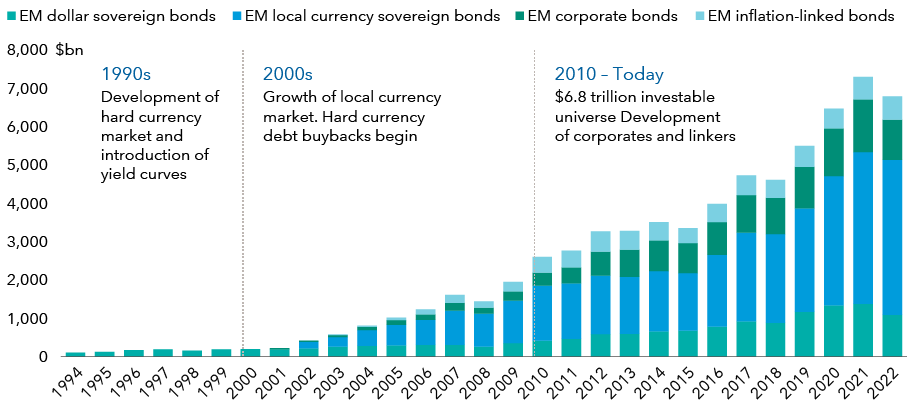

The fast-paced evolution of EMD as an asset class necessitates an investment approach that can adapt swiftly. At its inception in the mid-1990s, EMD was a relatively narrow asset class consisting of just 12-15 countries issuing hard currency debt. This was often in response to crises in those countries. As illustrated in the chart below, little changed until the early 2000s when local currency debt bonds and corporate bonds were introduced. Since then, the asset class has gradually expanded to encompass almost 70 countries1, issuing a broader range of debt instruments. In addition, some countries have made significant progress in establishing local yield curves, reducing their vulnerability to fluctuations in the US dollar and enhancing stability.

The market has developed into a mainstream asset class

Investors cannot invest directly in the index.

Data as at 31 December 2022, in US dollar terms. Indices: JPMorgan EMBI Global Index, JPMorgan GBI-EM Broad Index, JPMorgan CEMBI Broad Index, Bloomberg EMGIL Bond Index. Investable universe based on market value of indices used. Sources: JPMorgan, Bloomberg

In this Q&A, emerging market debt (EMD) portfolio manager Kirstie Spence discusses how to plan for the long-term success of managing the asset class.

1. As at September 2023. Based on JPMorgan EMBI Global Diversified Index.

Source: JPMorgan

Our latest insights

Past results are not predictive of results in future periods. It is not possible to invest directly in an index, which is unmanaged. The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment. This information is not intended to provide investment, tax or other advice, or to be a solicitation to buy or sell any securities.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. All information is as at the date indicated unless otherwise stated. Some information may have been obtained from third parties, and as such the reliability of that information is not guaranteed.

Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

Kirstie Spence

Kirstie Spence