Capital IdeasTM

Investment insights from Capital Group

Fixed Income

Investment-grade corporate bonds play a central role in a well-diversified fixed income portfolio, with the potential to generate attractive risk-adjusted returns. Many investors continue to maintain a preference for their domestic market when considering investment options.

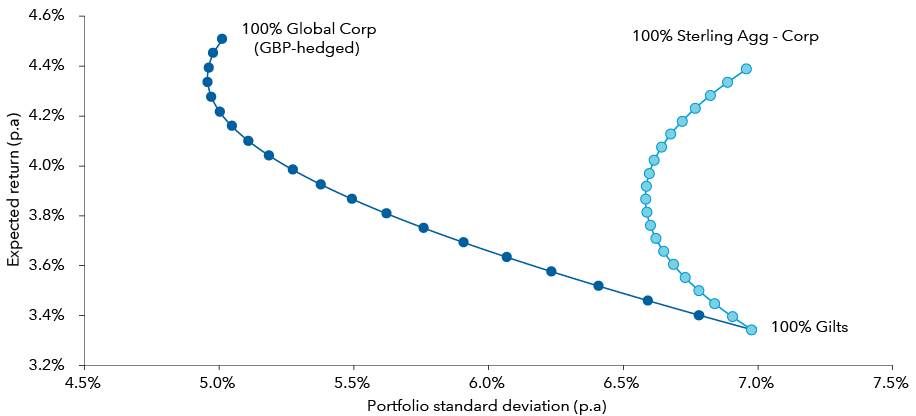

However, investment strategies focused solely on one’s own domestic market may not be able to spread risk effectively. The potential diversification benefits of adding more markets and issuers to a portfolio are intuitive to most, highlighting the advantages of a global portfolio over regional strategies. This is illustrated in the efficient frontier analysis chart below. As can be seen, diversifying UK gilts exposure using global corporates rather than UK corporates not only increases potential expected returns, but also reduces volatility. This is due to the diversified nature of the global corporate market.

Efficient frontier analysis

Comparing hypothetical fixed income portfolios

Past results are not a guarantee of future results

Selected assets include Sterling Aggregate – Corporates, UK Gilts, Global Aggregate – Corporates (GBP-hedged).

Monthly returns from January 2001 to 31 August 2023. Source: Bloomberg

Our latest insights

Past results are not predictive of results in future periods. It is not possible to invest directly in an index, which is unmanaged. The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment. This information is not intended to provide investment, tax or other advice, or to be a solicitation to buy or sell any securities.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. All information is as at the date indicated unless otherwise stated. Some information may have been obtained from third parties, and as such the reliability of that information is not guaranteed.

Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

Peter Becker

Peter Becker

Flavio Carpenzano

Flavio Carpenzano