Capital Group Future Generations Global Balanced Fund (LUX)

Investieren, wo Nachhaltigkeit und Chancen zusammentreffen

Aktuelle Mitteilungen für Anteilseigner

Your selection has changed, please hit "GO" to refresh.

Please wait. Page is being reloaded...

Ergebnisse

Informationen zum Index dienen nur zur Erläuterung und zur Illustration. Der Fonds wird aktiv gemanagt. Er wird nicht in Anlehnung an eine Benchmark gesteuert.

Die Ergebnisse der Vergangenheit sind kein Hinweis auf künftige Ergebnisse.

Preis und Ausschüttungen

Portfolio

Risiko-Betrachtungen

Risikofaktoren, die vor einer Anlage zu beachten sind:

- Diese Präsentation ist keine Investmentberatung oder persönliche Empfehlung.

- Der Wert von Anlagen und Erträgen kann schwanken, sodass Anleger ihr investiertes Kapital möglicherweise nicht oder nicht vollständig zurückerhalten.

- Die Ergebnisse der Vergangenheit sind kein Hinweis auf künftige Ergebnisse.

- Wenn Ihre Anlagewährung gegenüber der Währung aufwertet, in der die Anlagen des Fonds denominiert sind, verliert Ihre Anlage an Wert. Durch Währungsabsicherung wird versucht, dies zu begrenzen, aber es gibt keine Garantie, dass die Absicherung vollständig erfolgreich ist.

- Der Verkaufsprospekt – zusammen mit allen lokal erforderlichen Verkaufsunterlagen – nennen zusätzliche Risiken. Je nach Fonds können dazu auch die Risiken von Anlagen in festverzinslichen Wertpapieren, Derivative, Emerging Markets und/oder High-Yield-Anleihen zählen. Die Märkte der Emerging-Market-Länder sind volatil und können illiquide werden.

- Manche Fonds können zu Anlagezwecken, zur Absicherung und/oder zum effizienten Portfoliomanagement in derivative Finanzinstrumente investieren.

Ressourcen

Nachhaltigkeitsbezogene offenlegungen

Zusammenfassung

Kein nachhaltiges Investitionsziel

Dieser Fonds bewirbt ökologische und soziale Merkmale, hat aber kein nachhaltiges Investitionsziel. CRMC (der „Anlageberater“) verpflichtet sich jedoch, mindestens 40 % der Fondsanlagen in Unternehmen zu halten, die nach Meinung des Anlageberaters mit ihren aktuellen oder zukünftigen Produkten bzw. Dienstleistungen soziale und/oder ökologische Herausforderungen angehen.

Ökologische oder soziale Merkmale des Finanzprodukts

Der Fonds bewirbt ökologische und soziale Merkmale durch den Anlageprozess des Anlageberaters. Dabei wird die Investierbarkeit bewertet und eine Ausschlusspolitik angewendet.

Anlagestrategie

Der Fonds investiert in Unternehmen, deren Produkte und Dienstleistungen überwiegend konform mit einem oder mehreren vom Anlageberater identifizierten nachhaltigen Anlagethemen zu weltweiten sozialen und Umweltherausforderungen sind oder sich im Übergang zu einer stärkeren positiven Ausrichtung darauf befinden. Diese Themen orientieren sich an den Zielen für nachhaltige Entwicklung der Vereinten Nationen (Sustainable Development Goals, „SDGs“). Um zulässige Unternehmen zu identifizieren, führt der Anlageberater eine Bewertung durch, die auf internen Bottom-up-Analysen basiert, die von den Anlage- und ESG-Teams des Anlageberaters durchgeführt werden. Diese Bewertung der Investierbarkeit wird durch sektorbezogene „Merkmale“ (dabei wird beurteilt, ob die Produkte und Dienstleistungen einen Beitrag zu den SDGs liefern) und „Standards“ (welche die Steuerung von wesentlichen ESG-Risiken und die gute Unternehmensführung untersuchen) des Anlageberaters untermauert. Der Fonds investiert in „konforme“ Unternehmen, deren Wirtschaftstätigkeit derzeit mindestens zur Hälfte konform ist, sowie in Unternehmen, die sich „im Übergang befinden“ und die ihre Wirtschaftstätigkeit nach Auffassung des Anlageberaters aktiv umstellen, um sie stärker positiv auf vom Anlageberater identifizierte nachhaltige Anlagethemen und die SDGs auszurichten. Dabei werden kurz- bis mittelfristig wesentliche Änderungen erwartet. Daneben verwendet der Anlageberater ESG- und normenbasierte Ausschlüsse, um die Fondsanlagen beim Erwerb einer Ausschlusspolitik zu unterziehen. Bei staatlichen Emittenten führt der Anlageberater eine Bewertung der Investierbarkeit anhand seines internen Sovereign ESG-Framework durch. Dies beinhaltet eine Reihe von ESG-Indikatoren, um zu bewerten, wie gut ein Land sein ESG-Risiko kontrolliert. Der Anlageberater verwendet sein internes Sovereign ESG-Framework, um das ESG- und Governance-Rating eines staatlichen Emittenten anhand vorab festgelegter Schwellenwerte zu bewerten. Zudem werden staatliche Emittenten, die bestimmte Menschenrechtskriterien nicht erfüllen, vom Anlageuniversum des Fonds ausgeschlossen. Capital Group hat eine Reihe von Kriterien aufgestellt, um zu beurteilen, ob ein Unternehmen keinen erheblichen Schaden verursacht und so festzustellen, ob die Anlage eine nachhaltige Investition ist. Der Fonds berücksichtigt bei Anlagen in Unternehmen die WNA-Indikatoren zu den wichtigsten nachteiligen Auswirkungen, über die verpflichtend berichtet werden muss und die in Anhang I Tabelle 1 der Delegierten Verordnung (EU) 2022/1288 der Kommission aufgeführt sind. Außerdem berücksichtigt er andere ESG-Risiken und Kontroversen, die der Anlageberater für potenziell wesentlich hält, wie in den vorstehend genannten sektorbezogenen Standards beschrieben, zum Beispiel Probleme im Bereich Datenschutz oder Zensur. Bei der Bewertung der Verfahrensweisen sieht sich der Anlageberater mindestens Aspekte an, die er in Bezug auf die vier genannten Säulen einer guten Unternehmensführung für relevant hält (d. h. solide Managementstrukturen, Beziehungen zu Arbeitnehmern, Vergütung von Mitarbeitern sowie Einhaltung der Steuervorschriften).

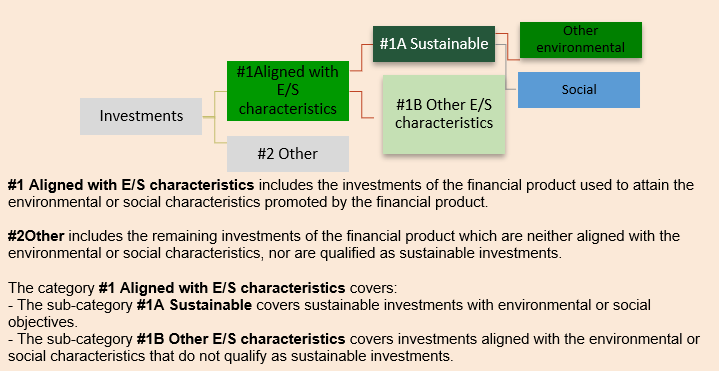

Anteil der Investitionen

Mindestens 90 % der Fondsanlagen werden zur Erreichung der beworbenen ökologischen oder sozialen Merkmale getätigt (#1 Ausgerichtet auf ökologische oder soziale Merkmale). Der Fonds investiert einen Mindestanteil von 40 % in die Unterkategorie „#1A Nachhaltige Investitionen“ und maximal 60 % in die Kategorie „#1B Andere ökologische oder soziale Merkmale“. Maximal 10 % der Anlagen des Fonds, einschließlich nicht auf die beworbenen ökologischen oder sozialen Merkmale ausgerichtete Anlagen und/oder Derivate, fallen in die Kategorie „#2 Andere Investitionen“.

Liquide Mitteln sind in den oben genannten Vermögensanteilen nicht enthalten. Sie können zu Liquiditätszwecken gehalten werden.

Überwachung von ökologischen oder sozialen Merkmalen

Folgende Nachhaltigkeitsindikatoren werden vom Fonds herangezogen, um die Erreichung der einzelnen ökologischen oder sozialen Merkmale, die durch ihn beworben werden, zu messen:

- die Einhaltung der in der Ausschlusspolitik festgelegten Kriterien durch die Unternehmensmittenten,

- Anteil der staatlichen Emittenten, die auf den Prozess zur Bewertung von staatlichen Emittenten des Anlageberaters entfallen,

- Anteil der Investitionen, bei denen mindestens 50 % des Umsatzes mit den SDGs konform ist, und

- Anteil der Investitionen in Unternehmen, die sich „im Übergang befinden“.

Methoden

Der Fonds setzt zwei verbindliche ESG-bezogene Kriterien um: sektor- und normenbasierte Screenings in Form von Ausschlüssen und eine Verpflichtung zu nachhaltigen Investitionen.

Datenquellen und -verarbeitung

Der Fonds nutzt mehrere Datenquellen, einschließlich unter anderem MSCI ESG Business Involvement Screening Research („MSCI ESG”) und die von MSCI ermittelte Liste der Unternehmen, die gegen die UNGC-Grundsätze verstoßen. Diese Daten decken allerdings möglicherweise nicht das gesamte Spektrum der Tätigkeiten eines Emittenten ab, ändern sich plötzlich, können fehlerhaft, nicht zutreffend, unvollständig oder veraltet sein. Das kann dazu führen dass ein Fonds in einen Emittenten investiert, dessen Ausschluss ein Anleger erwarten könnte. Capital Group überprüft externe Datenquellen laufend sorgfältig und bemüht sich sicherzustellen, dass Daten von Drittanbietern vertrauenswürdig sind. Wenn der Anlageberater Daten und/oder eine Bewertung für unvollständig oder nicht zutreffend hält, behält er sich das Recht vor, die Beteiligung des betreffenden Unternehmens durch eine eigene Bewertung zu ermitteln.

Einschränkungen bei Methoden und Daten

Die Methoden und Quellen in Bezug auf die Ausschlüsse und den ESG-Integrationsansatz als Ganzes weisen gewisse Einschränkungen auf. Um alle börsennotierten Unternehmen weltweit zu ermitteln, die in Aktivitäten wie die Herstellung umstrittener Produkte und Einnahmen aus Aktivitäten involviert sind, die nicht mit den ESG- und normenbasierten Screenings übereinstimmen, verwendet der Fonds ESG-Kriterien und Ausschlüsse, die hauptsächlich durch Drittanbieter bestimmt werden.

Due Diligence

Die Mitarbeitenden der Compliance-, Risiko- und internen Auditfunktion von Capital Group bewerten regelmäßig den Aufbau und die Wirksamkeit der Aktivitäten und wichtigen Kontrollsysteme der Firma. Dies umfasst die Einhaltung interner Abläufe und Verfahren sowie des Regulierungsumfelds in den Rechtsordnungen, in denen das Unternehmen tätig ist.

Engagement-Richtlinien

Der Dialog mit Unternehmen ist fester Bestandteil der Vermögensverwaltungsdienste, die der Anlageberater seinen Kunden erbringt. Wenn die Anlageteams von Capital Group ein Problem identifizieren, das für den langfristigen Wert eines Beteiligungsunternehmens wesentlich ist, oder sie die relative ESG-Leistung bedenklich finden, tauschen sich die Anlageexperten und Governance-Teams von Capital Group mit der Unternehmensleitung aus.

Bestimmter Referenzwert

Der Fonds hat keinen Referenzwert für die Erreichung der von ihm beworbenen ökologischen und/oder sozialen Merkmale bestimmt.

The sustainability-related disclosures are meant to be revised as necessary from time to time to capture any changes or reviews. The capitalized terms are used in accordance with the definitions and references outlined in Capital International Fund Prospectus.

Capital International Fund - Capital Group Future Generations Global Balanced Fund (LUX) (the “Fund”)

LEI: 549300QTCEF0GTIIHN03

The below section “Summary” was prepared in English and is being translated to other official languages of the European Economic Area. In case of any inconsistency(ies) or conflict(s) between the different versions of this section “Summary”, the English language version shall prevail.

Summary

No sustainable investment objective

This Fund promotes environmental or social characteristics, but does not have as its objective sustainable investment. However, CRMC (the “Investment Adviser”) commits to maintain at least 40% of the Fund’s investments in companies that, in the Investment Adviser’s opinion, are addressing social and/or environmental challenges through their current or future products and/or services.

Environmental or social characteristics of the financial products

The Fund promotes environmental and social characteristics through the Investment Adviser’s investment process, which applies an eligibility assessment and a Negative Screening Policy.

Investment strategy

The Fund invests in companies whose products and services are majority-aligned, or transitioning towards higher positive alignment, with any single or combination of sustainable investment themes focused on global social and environmental challenges as identified by the Investment Adviser. These themes map to the United Nations Sustainable Development Goals (“SDGs”). To identify eligible companies, the Investment Adviser performs an assessment that relies on bottom-up proprietary research conducted by the Investment Adviser’s investment and ESG teams. This eligibility assessment is underpinned by the Investment Adviser’s sector-level “Characteristics” (which assess whether products and services contribute to the SDGs) and “Standards” (which examine management of material ESG risks and good governance). The Fund invests in ‘Aligned’ companies that currently have at least half of their business aligned, as well as ‘Transitioning’ companies that the Investment Adviser believes are actively transitioning their business to higher positive alignment with sustainable investment themes as identified by the Investment Adviser and with the SDGs, with material near-to-medium term change expected. In addition, the Investment Adviser applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments at the time of purchase. For sovereign issuers, the Investment Adviser conducts an eligibility assessment leveraging its proprietary sovereign ESG framework, which covers a range of ESG indicators to evaluate how well a country manages its ESG risk. The Investment Adviser uses its proprietary sovereign ESG framework to assesses the ESG and Governance score of a sovereign issuer against predetermined thresholds. In addition, sovereigns that fail certain human rights criteria will be excluded from the eligible universe of the Fund. Capital Group has developed a set of criteria to assess whether a company does significant harm to determine whether the investment constitutes a sustainable investment. The Fund considers the mandatory PAIs as set out in Table 1 of Annex I of Commission Delegated Regulation (EU) 2022/1288 for corporate investments, as well as other ESG risks and controversies that the Investment Adviser considers potentially material as outlined in the sector-level Standards described above, such as data privacy or censorship issues. When assessing good governance practices, the Investment Adviser will, as a minimum, have regard to matters it sees relevant to the four prescribed pillars of good governance (i.e., sound management structures, employee relations, remuneration of staff and tax compliance).

Proportion of investments

At least 90% of the Fund's investments are used to attain the environmental or social characteristics promoted by the Fund (#1 Aligned with E/S characteristics). The Fund will have a minimum proportion of 40% in the sub-category “#1A Sustainable”, and a maximum of 60% will be in category “#1B Other E/S characteristics”. A maximum of 10% of the Fund’s investments, including investments non-aligned with the E/S characteristics promoted and/or derivatives are in category “#2 Other”.

Cash and cash-equivalents are not included in the % of assets set out above. They may be held for liquidity purposes.

Monitoring of environmental or social characteristics

The sustainability indicators used by this Fund to measure the attainment of each of the environmental or social characteristics it promotes are the following:

Adherence of corporate issuers to the criteria set forth in the Negative Screening Policy,

Percentage of sovereign issuers falling under the Investment Adviser’s process for assessing sovereigns,

Percentage of investments having at least 50% of their revenue aligned with the SDGs, and

Percentage of investments in companies considered as “Transitioning”.

Methodologies

The Fund implements two binding ESG-related criteria: sector- and norms-based screens in the form of exclusions and a commitment to make sustainable investments.

Data sources and processing

The Fund uses several data sources including, but not limited to, MSCI ESG Business Involvement Screening Research (“MSCI ESG”) and MSCI United Nations Global Compact violators. However, such data might not capture the full universe of activities of an issuer, change suddenly, be flawed, inaccurate, incomplete or outdated, resulting in a Fund’s investment in an issuer which an investor may expect to be excluded. Capital Group performs ongoing due diligence on third-party data sources and endeavours to ensure that third-party data is reliable. In the event that the Investment Adviser believes that data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify relevant business involvement activities through its own assessment.

Limitations to methodologies and data

The methodology and sources relating to the exclusions and the ESG integration approach as a whole have certain limitations. In order to identify all publicly traded companies globally which are involved in activities such as the production of controversial products and revenue derived from activities that are inconsistent with the ESG and norms-based screens, the Fund uses ESG criteria and exclusions that are primarily identified through third-party providers.

Due diligence

Members of Capital Group's compliance, risk management and internal audit staff conduct periodic assessments on the design and operating effectiveness of the firm’s activities and key controls. This includes compliance with internal processes and procedures as well as with the regulatory landscape in the jurisdictions in which the company operates.

Engagement policies

Establishing dialogue with companies is an integral part of the Investment Adviser’s investment management service to clients. Where Capital Group's investment teams identify an issue material to the long-term value of an investee company or they are concerned about relative ESG performance, Capital Group's investment professionals and governance teams will engage with management.

Designated reference benchmark

The Fund has not designated a reference benchmark to meet the environmental and/or social characteristics it promotes.

No sustainable investment objective

This Fund promotes environmental or social characteristics but does not have as its objective sustainable investment. The Investment Adviser commits to maintain at least 40% of the Fund’s investments in companies that, in the Investment Adviser’s opinion, are addressing social and/or environmental challenges through their current or future products and/or services. This 40% minimum qualifies as “sustainable investments” under Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector.

How have the indicators for adverse impacts on sustainability factors been taken into account?

As mentioned above, the Investment Adviser considers all mandatory PAIs.

The Investment Adviser considers several PAIs within its Negative Screening Policy. In particular, the Negative Screening Policy addresses PAI 4 on exposure to companies active in the fossil fuel sector, PAI 10 on United Nations Global Compact violators and PAI 14 on controversial weapons.

Beyond the negative screening process, with respect to the remaining mandatory PAIs:

where the Investment Adviser considers sufficient and reliable quantitative data is available across the investment universe (for PAIs 1, 2, 3, 6, and 13), the Investment Adviser uses third-party data and prescribed thresholds to determine whether the adverse impact associated with the company’s activities is potentially significant based on the company’s relative ranking (on the specific adverse impact) to the overall investment universe and/or peer group; or

where data availability or quality is not sufficient across the investment universe to enable a quantitative analysis (for PAIs 5, 7, 8, 9, 10, 11, and 12), the Investment Adviser assesses significant harm on a qualitative basis, for example using proxies. The Investment Adviser’s assessment will also include an overall qualitative assessment of how ESG risks are being managed.

Where third party data or the Investment Adviser’s qualitative assessment indicates that a company is potentially doing significant harm based on a PAI threshold, the Investment Adviser will do additional due diligence to better understand and assess negative impacts indicated by third party or proprietary data. If the Investment Adviser concludes that the company is not causing significant harm based on its analysis, it may proceed with the investment and the rationale for that decision will then be documented. For example, the Investment Adviser may conclude a company is not causing significant harm if (i) the Investment Adviser has reason to believe that third-party data is inaccurate and the Investment Adviser’s own research demonstrates that the company is not causing significant harm; or (ii) the company is taking steps to mitigate or remediate that harm through the adoption of timebound targets and there are meaningful signs of improvement and positive change.

How are the sustainable investments aligned with the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights? Details:

The sustainable investments are aligned with the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights as follows: the Investment Adviser reviews companies involved in significant ESG controversies, with a focus on those that may conflict with existing global standards, including guidelines from the United Nations Global Compact. In accordance with the Negative Screening Policy applied to the Fund, the Investment Adviser will exclude companies violating the UN Global Compact principles. Although other incidents will not automatically result in exclusion from the Fund, the Investment Adviser ensures that appropriate action to remediate the concerns are taken.

Environmental or social characteristics of the financial product

The Fund promotes environmental and/or social characteristics through the Investment Adviser’s investment process, which applies an eligibility assessment and a Negative Screening Policy.

The Fund invests in companies whose products and services are majority-aligned, or transitioning towards higher positive alignment, with any single or combination of sustainable investment themes focused on global social and environmental challenges as identified by the Investment Adviser. These themes map to the United Nations Sustainable Development Goals (“SDGs”).

To identify eligible companies, the Investment Adviser performs an assessment that relies on bottom-up proprietary research conducted by the Investment Adviser’s investment and ESG teams. This eligibility assessment is underpinned by the Investment Adviser’s sector-level “Characteristics” (which assess whether products and services contribute to the SDGs) and “Standards” (which examine management of ESG risks and good governance). The Fund invests in ‘Aligned’ companies that currently have at least half of their business aligned, as well as ‘Transitioning’ companies that the Investment Adviser believes are actively transitioning their business to higher positive alignment, with material near-to-medium term change expected. In addition, the Investment Adviser applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments at the time of purchase.

For sovereign issuers, the Investment Adviser conducts an eligibility assessment leveraging its proprietary sovereign ESG framework, which covers a range of ESG indicators to evaluate how well a country manages its ESG risk. The Investment Adviser uses its proprietary sovereign ESG framework to assesses the ESG and Governance score of a sovereign issuer against predetermined thresholds. In addition, sovereigns that fail certain human rights criteria will be excluded from the eligible universe of the Fund.

There is no reference benchmark designated for the purpose of attaining the environmental or social characteristics promoted by the Fund.

Investment strategy

The Investment Adviser applies the following investment strategy to attain the environmental and/or social characteristics promoted and the sustainable investment objective as follows:

The Fund invests in companies whose products and services are majority-aligned, or transitioning towards higher positive alignment, with any single or combination of sustainable investment themes focused on global social and environmental challenges as identified by the Investment Adviser. These themes map to the United Nations Sustainable Development Goals (“SDGs”).The themes map to the following key United Nations Sustainable Development Goals (“SDGs”):

| Themes | Key Associated UN SDGs |

|---|---|

| Health & Well-Being |

|

| Energy Transition |

|

| Sustainable Cities & Communities |

|

| Responsible Consumption |

|

| Education & Information Access |

|

| Financial Inclusion |

|

| Clean Water & Sanitation |

|

To identify such companies, the Investment Adviser performs an eligibility assessment that relies on bottom-up proprietary research conducted by the Investment Adviser’s investment and ESG teams. This eligibility assessment is underpinned by the Investment Adviser’s sector-level “Characteristics” and “Standards”:

Characteristics: focus on whether products and services contribute to the SDGs; and

Standards: focus on management of material ESG risks and good governance.

The Fund invests in ‘Aligned’ companies that currently have at least half of their business aligned, as well as ‘Transitioning’ companies that the Investment Adviser believes are actively transitioning their business to higher positive alignment with material near-to-medium term change expected. If a company is determined to be aligned or transitioning and purchased in the Fund, but fails to meet the aligned or transitioning requirements thereafter, such company would no longer be considered a sustainable investment anymore and would generally be sold within six months from the date of such determination, subject to the best interests of investors in the Fund.

In addition, the Investment Adviser applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments at the time of purchase.

This is supported by ongoing monitoring of the portfolio, performed by the Investment Adviser, against criteria set out in the Negative Screening Policy to identify any holdings that would be precluded. Any such company would no longer be considered a sustainable investment anymore and would generally be sold within six months from the date of such determination, subject to the best interests of investors in the Fund.

The activities and thresholds, from the Negative Screening Policy, applied to determine the list of companies to be excluded from the Funds’ investment universe consist of the following:

| Activities | Threshold |

|---|---|

| United Nations Global Compact (UNGC) | Companies that, in the Investment Adviser’s opinion, are violating the UNGC should be excluded. |

| Tobacco | Companies generating >5% of their revenue from the manufacture of tobacco products should be excluded. |

| Controversial Weapons | Companies with any ties to controversial weapons (cluster munitions, landmines, biological/chemical weapons, depleted uranium weapons, blinding laser weapons, incendiary weapons, and/or non-detectable fragments) should be excluded. |

| Nuclear Weapons | Companies generating any revenue from the production of nuclear weapons should be excluded. |

| Weapons | Companies generating >10% of their revenue from weapon systems, components and support systems and services should be excluded. |

| Oil & Gas Upstream Producers | Companies engaging in, or generating any revenue from, the exploration & production of oil and gas should be excluded. |

| Thermal Coal | Companies generating >10% of their revenue from the production and/or distribution of thermal coal should be excluded. |

When assessing potential investee companies, the Investment Adviser relies on third-party providers who identify a company’s participation in or the revenue which they derive from activities that are inconsistent with these screens. In the event that exclusions cannot be verified through third-party providers or if the Investment Adviser believes that data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify business involvement activities through its own assessment (including by using other third-party data sources).

Companies that fail both the eligibility process and the Negative Screening Policy are considered not to contribute to the Fund’s environmental and/or social characteristics.

For sovereign issuers, the Investment Adviser conducts an eligibility assessment leveraging its proprietary sovereign ESG framework, which covers a range of ESG indicators to evaluate how well a country manages its ESG risk. To be eligible for investment, sovereigns must fulfil the following criteria: (i) score above pre-determined thresholds for their proprietary ESG score on both an absolute and GNI-adjusted basis; and (ii) score above pre-determined thresholds on the governance indicator input of their proprietary ESG score on both an absolute and GNI-adjusted basis. In addition, sovereigns that fail certain human rights criteria will be excluded from the eligible universe of the Fund. If the Investment Adviser believes that the third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify exclusions for sovereign issuers through its own assessment. The Investment Adviser also periodically reviews sovereign issuers and if a previously eligible sovereign issuer held in the Fund becomes ineligible, the sovereign issuer will not contribute towards the environmental and/or social characteristics of the Fund and the sovereign issuer will generally be sold within six months from the date of such determination, subject to the best interests of investors in the Fund (save that if the Investment Adviser believes that a score is below a pre-defined threshold for a temporary or a transitory reason, the Investment Adviser may, from time to time, exercise its discretion to keep holding or purchase securities issued by the sovereign issuer).

What is the policy to assess good governance practices of the investee companies?

When assessing good governance practices, the Investment Adviser will, as a minimum, have regard to matters it sees relevant to the four prescribed pillars of good governance (i.e., sound management structures, employee relations, remuneration of staff and tax compliance).

The Investment Adviser assesses the quality of corporate governance practices of companies as part of its eligibility assessment when examining ESG risks, and as part of its ESG integration process more broadly. The Investment Adviser’s fundamental analysis covers a range of governance metrics including among others, audit practices, board composition, tax paid, controversies and executive compensation. The Investment Adviser engages in regular dialogue with companies on corporate governance issues and exercises its proxy voting rights for the entities in which the Fund invests.

As described above, the Investment Adviser applies a Negative Screening Policy to the Fund. As part of this, the Investment Adviser excludes companies violating the United Nations Global Compact (UNGC) principles as well as those violating principle 10 on anti-corruption and principle 3 on employee relations.

Capital Group's ESG Policy Statement provides additional detail on the Investment Adviser's ESG integration approach and processes, including proxy voting procedures and principles, as well as views on specific ESG issues, including ethical conduct, disclosures and corporate governance. Information on the Investment Adviser’s corporate governance principles can be found in its Proxy Voting Procedures and Principles.

Further details can be found in the ESG Policy Statement on:

https://www.capitalgroup.com/content/dam/cgc/tenants/eacg/esg/files/esg-policy-statement(en).pdf

Proportion of investments

At least 90% of the Fund's investments are used to attain the environmental or social characteristics promoted by the Fund (#1 Aligned with E/S characteristics). The Fund will have a minimum proportion of 40% in the sub-category “#1A Sustainable”, and a maximum of 60% will be in category “#1B Other E/S characteristics”.

A maximum of 10% of the Fund’s investments, including investments non-aligned with the E/S characteristics promoted and/or derivatives are in category “#2 Other”.

Cash and cash-equivalents are not included in the % of assets set out above. They may be held for liquidity purposes.

Monitoring of environmental or social characteristics

The sustainability indicators used by this Fund to measure the attainment of each of the environmental or social characteristics it promotes are the following:

Percentage of corporate issuers falling under the sectors defined as part of the Negative Screening Policy,

Percentage of sovereign issuers falling under the Investment Adviser’s process for assessing sovereigns,

Percentage of investments having at least 50% of their revenue aligned with the SDGs, and

Percentage of investments in companies considered as “Transitioning”.

Methodologies

The methodologies used to measure how the environmental and/or social characteristics are met are as follows:

Eligibility process: the Investment Adviser seeks to invest in companies whose products and services are majority-aligned, or transitioning towards higher positive alignment, with any single or combination of sustainable investment themes focused on global social and environmental challenges as identified by the Investment Adviser. These themes map to the United Nations Sustainable Development Goals (“SDGs”). ‘Aligned’ companies currently have at least half of their business aligned and ‘Transitioning’ are companies that the Investment Adviser believes are actively transitioning their business to higher positive alignment with sustainable investment themes as identified by the Investment Adviser and with the SDGs, with material near-to-medium term change expected. The Investment Advisor typically uses revenue to assess business alignment, however in some instances other metrics may be more relevant, for example, energy production mix for utilities. The business alignment is accompanied by a qualitative assessment of the company’s product and service contribution to the SDGs, as well as risk of misalignment. It will also consider how material ESG risks and opportunities are being addressed and managed by the company, such as the quality of corporate governance practices and any adverse environmental or social impacts. For Transitioning companies in particular, company development pathway and timeline to reach intended impact is also considered.

Relevant KPIs and targets, as well as topics for engagement, are also identified at the time of eligibility and tracked over time. For Transitioning companies in particular, KPIs may include aligned revenue, as well as other transition metrics. Progress against these KPIs and targets is assessed periodically.

Research is conducted by the Investment Advisor’s ESG analysts and investment analysts. Eligibility decisions are voted on by the strategy’s Principal Investment Officers, Portfolio Managers, and ESG leadership.

Negative Screening Policy: the Investment Adviser applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments at the time of purchase. The Investment Adviser relies on third-party providers who identify a company’s participation in or the revenue which they derive from activities that are inconsistent with these screens. In the event that exclusions cannot be verified through third-party providers or if the Investment Adviser believes that data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify business involvement activities through its own assessment (including by using other third-party data sources).

For sovereign issuers, to be eligible for investment, sovereigns must fulfil the following criteria: (i) score above pre-determined thresholds for their proprietary ESG score on both an absolute and GNI-adjusted basis; and (ii) score above pre-determined thresholds on the governance indicator input of their proprietary ESG score on both an absolute and GNI-adjusted basis. In addition, sovereigns that fail certain human rights criteria will be excluded from the eligible universe of the Fund. If the Investment Advisor believes that the third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify exclusions for sovereign issuers through its own assessment.

Engagement: Engagements are conducted by the ESG team in collaboration with our investment professionals. We engage management teams on topics that are informed by our research, ESG investment frameworks, voting and monitoring process.

Proxy Voting: We have investment professional-led proxy voting, with our in-house Global Stewardship & Engagement (GSE)/Proxy team conducting analysis. Final proxy outcomes are decided by members of our investment units.

Data sources and processing

Data sources

The Fund uses several data sources as part of the investment process.

In relation to the SDGs alignment, the Investment Adviser typically uses revenue to assess business alignment, but will leverage other metrics if there are more sector-relevant financial metrics for a company and its industry.

The data sources used as part of the Negative Screening Policy are as follows:

| Activities | Datasource |

|---|---|

| United Nations Global Compact (UNGC) | Companies are identified through MSCI’s UNGC violators. |

| Tobacco | Companies are identified through MSCI’s Tobacco Producer – Maximum Percentage of Revenue factor name. |

| Controversial Weapons | Companies are identified through MSCI’s Controversial Weapons – Any Tie factor name. |

| Nuclear Weapons | Companies are identified through MSCI’s Weapons – Nuclear Maximum Percentage of Revenue factor name. |

| Weapons | Companies are identified through MSCI’s Weapons – Maximum Percentage of Revenue factor name. |

| Oil & Gas Upstream Producers | Equity: Companies are identified through Global Industry Classification Standard (GICS) “Integrated Oil & Gas” and “Oil & Gas Exploration & Production” sub-sector classifications. Fixed Income: Companies are identified through Barclays Global Sector Classification (BCLASS) “Independent” and “Integrated” sectors. |

| Thermal Coal | Companies are identified through MSCI’s Thermal Coal – Maximum Percentage of Revenue factor name. |

In the event that exclusions cannot be verified through third-party data or if the Investment Adviser believes that third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify business involvement activities through its own assessment (including by using other third-party data sources).

Exclusions for sovereign issuers are identified through the Investment Adviser’s proprietary research. The Investment Adviser leverages data from third-party institutions such as the United Nations and the World Bank to calculate ESG scores across the sovereign universe. Sovereign issuers are evaluated on: (1) a gross national income-adjusted basis to better understand how well a country manages ESG risk relative to its wealth and available resources, as well as (2) on an absolute basis. If the Investment Advisor believes that the third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify exclusions for sovereign issuers through its own assessment.

Data quality and processing

Capital Group periodically reviews the performance quality of provider organizations and conducts ongoing monitoring and due diligence activities commensurate with the significance of the services provided.

Data are regularly updated in Capital Group’s internal platforms and made available to relevant teams. When issues are identified in third-party data, they are reported back to the provider(s). The Investment Adviser also applies systematic data quality checks to catch discrepancies and validate with the provider when issues arise.

Proportion of data that is estimated

Third-party providers may estimate data. While reported data are prioritized, Capital Group uses estimated data when reported data are unavailable. The proportion of estimated data varies depending on the data point due to inconsistencies in reporting by investee companies.

Limitations to methodologies and data

The Investment Adviser may be reliant on third-party data or a combination of third-party data and Capital Group’s proprietary research and analysis. However, such data might not capture the full universe of activities of an issuer, change suddenly, be flawed, inaccurate, incomplete or outdated, resulting in a Fund’s investment in an issuer which an investor may expect to be excluded from the portfolio. Capital Group performs ongoing due diligence on third-party data sources and endeavours to ensure that third-party data is reliable.

In addition, in the event that data cannot be obtained through third-party providers or if the Investment Adviser believes that third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify business involvement activities through its own assessment (including by using other third-party data sources).

Due diligence

Members of Capital Group's compliance, risk management and internal audit staff conduct periodic assessments on the design and operating effectiveness of the firm’s activities and key controls. This includes compliance with internal processes and procedures as well as with the regulatory landscape in the jurisdictions in which the company operates. Capital Group meets regularly with the third-party data providers to review the quality of the services provided.

Pre-trade and post-trade checks are also in place as further explained in section “Monitoring of environmental or social characteristics” above.

Engagement policies

Establishing dialogue with companies is an integral part of the Investment Adviser’s investment management service to clients. Capital Group’s investment teams meet on a regular basis with company management, including executive and non-executive directors, chairs and finance directors. This enables the company to engage and generate dialogue on any issues that could affect the company’s long-term prospects, including exposures to sustainability issues.

Where Capital Group's investment teams identify an issue material to the long-term value of a company or they are concerned about relative ESG performance, Capital Group's investment professionals and governance teams will engage with management. Management’s response and the steps they take to minimise any associated risks, forms an important part of Capital Group's assessment of management quality, which itself is a key factor in the stock selection decisions.

Designated reference benchmark

The Fund has not designated a reference benchmark to meet the environmental and/or social characteristics it promotes.

Where can more product-specific information be found?

https://docs.publifund.com/1_PROSP/LU1577354035/en_LU

More product-specific information can be found in the periodic reports: