FUNDAMENTAL RESEARCH

We want to know a company top to bottom. The people and the culture, not just the financials.

We're thought leaders.

Our proprietary, fundamental research goes beyond spreadsheets and third-party ratings to provide distinct global perspectives that give investors and thought leaders an edge.

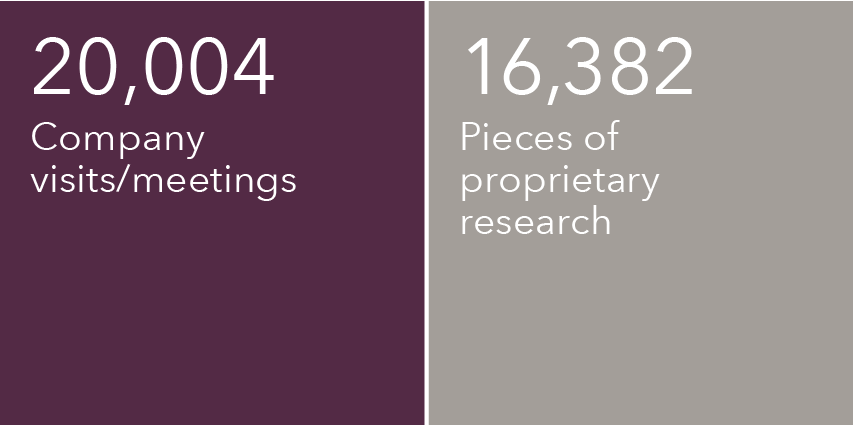

- Each year, our investment professionals hold thousands of meetings with companies, including one-on-ones with executives and onsite facilities visits, to help inform their investment decisions.

- Our macroeconomic, policy and political analysts provide additional insight on geopolitical, trade and economic risks, as well as opportunities. Together, managers and analysts produce thousands of proprietary research reports each year.

Figures reflect totals for the year ending December 31, 2023.

We played a historic role in creating global stock indices.

In the 1960s in Geneva, Capital Group analyst and statistician Nilly Sikorsky helped found the indices that would eventually become the MSCI indices.

We created the Capital International indices in the 1960s, now known as the Morgan Stanley Capital International (MSCI) indices, to help evaluate companies and compare their results with global competitors.

We bring fundamental research to Canadian investors.

Everything we do is rooted in deep, proprietary fundamental research, with a rigour that goes beyond spreadsheets and third-party ratings. We provide a distinct global perspective that gives you an edge.

See current results for all of

our portfolios and series.

What makes Capital Group different

Your goals power ours

We have four distinctive qualities central to helping you succeed.

More ways in which we are different

THE CAPITAL SYSTEM

Our proprietary approach prioritizes consistent and repeatable results

INDEPENDENT AND PRIVATE

GLOBAL SCALE

*Capital Group was voted #1 for thought leadership in 2019, 2020, 2021 and 2023 among U.S. advisors. Source: Marketing Support: The Advisor View, May 2023, July 2021, June 2020; Fund Intelligence, February 2020. FUSE Research surveys of 500–1,000 U.S. advisors identifying the “most-read thought leaders.” Survey was not conducted in 2022.

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Capital Group funds in Canada are managed by Capital International Asset Management (Canada), Inc., part of The Capital Group Companies, Inc., a global investment management firm originated in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

Unless otherwise noted, all above references to Capital Group refer to the global organization.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. Capital Group funds offered on this website are available only to Canadian residents.