Twenty-five years ago in March, the tech-heavy Nasdaq Composite reached its peak, marking the bursting of the dot.com bubble. Investors may have this on their minds as many leading artificial intelligence stocks have run into a wall.

Will the AI revolution be a repeat history lesson of the dot.com period?

So far in 2025, five of the so-called Magnificent Seven tech stocks that have invested aggressively in AI — Apple, Microsoft, NVIDIA, Amazon and Alphabet — have declined, lagging the broader S&P 500 Index through 20 March.

Two developments have caused investors to question the wisdom of spending billions to buildout data centres: news that Chinese firm DeepSeek developed a less expensive AI model and Microsoft’s disclosure that it will be pumping the brakes on some data centre projects. A third concern is the broader market volatility brought on by tariffs imposed by the Trump administration.

Although these are important considerations for investors, surprise twists are inevitable in the development of any emerging technology, according to US economist Jared Franz.

"Alternating periods of excitement and disappointment are common with new technologies,” Franz explains. “What is different with AI is that it is happening so rapidly. New models are rolled out every two weeks. Investors should expect more surprises. But over the long term, make no mistake: AI will have a profound impact on the economy and everything we do.”

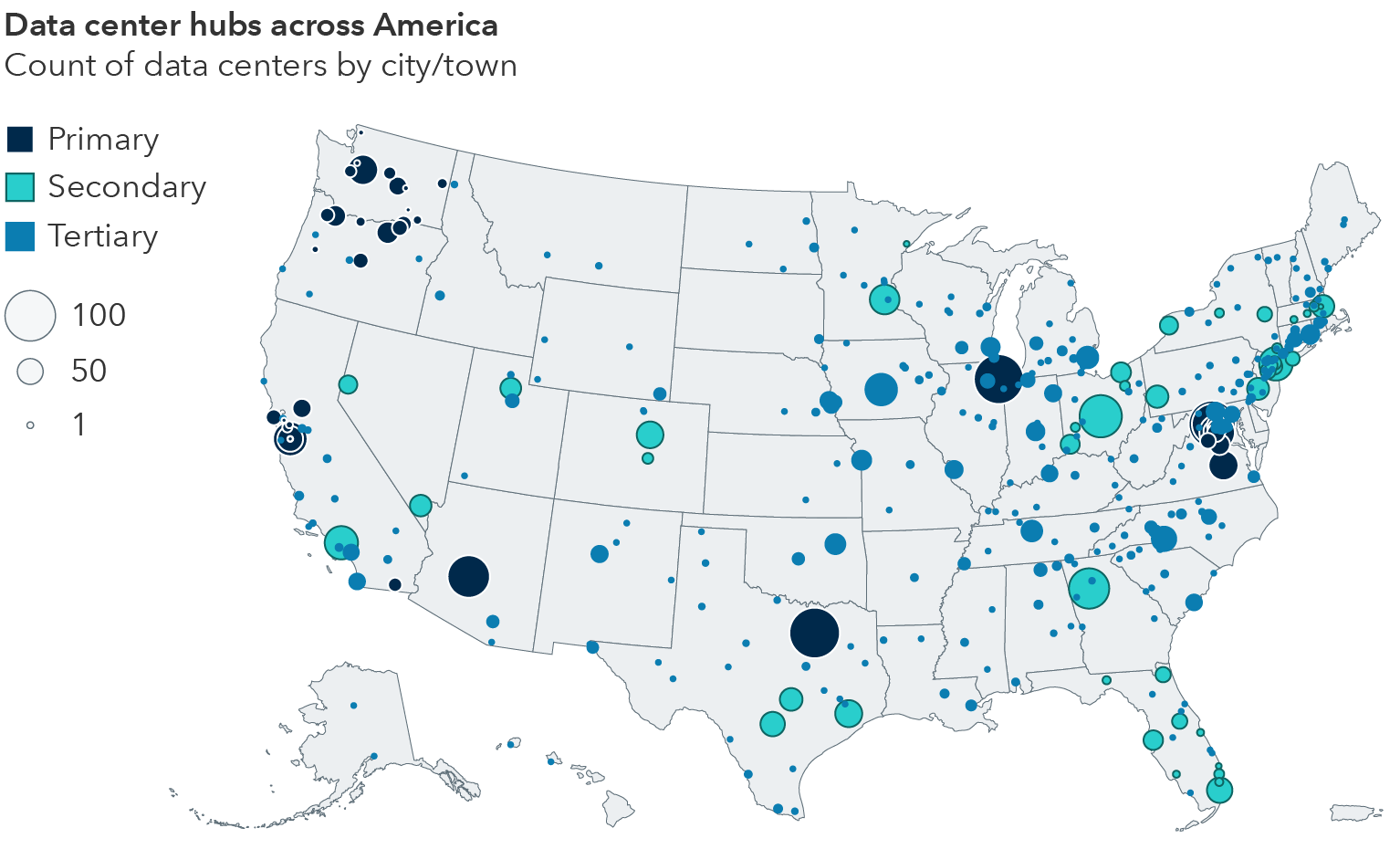

Indeed, the buildout of the technology has transformed the American economic landscape, bolstering regions of the country left behind by the digital economy and driving opportunity for businesses outside the tech sphere. Here are four factors to consider when evaluating AI’s impact and how investment opportunity may be evolving.

1. AI is transforming the American heartland

Although stocks may be volatile, companies continue to spend aggressively, as is evident from the view on the ground.