Capital IdeasTM

Investment insights from Capital Group

ESG

Soaring inflation and sharp shifts in equity market leadership have taken their toll on investors over the past 18 months or so. But how are these market events playing out in the ESG arena?

As inflation shows signs of abating and investors look to put cash to work, nearly a third of professionals we surveyed indicated they would increase allocations to ESG bonds funds, while the rollercoaster ride of equity markets has motivated 35% of ESG investors to consider neutralising style biases within their equity allocation.

These are just some of the insights revealed in Capital Group’s 2023 ESG Global Study.

Our annual survey gathers the views of more than 1,100 institutional and wholesale investment professionals across Europe, the Middle East, North America and Asia-Pacific to gain insights on ESG attitudes and adoption.

So what do investors really think about ESG, and what actions are they taking?

Global events and market shifts are also playing into considerations on ESG allocation

From extreme weather and the war in Ukraine, which have pushed the energy transition to the top of the agenda, to a reduction in inequality and improvements in supply chain standards, investors are increasingly looking to address multiple themes through their ESG investments.

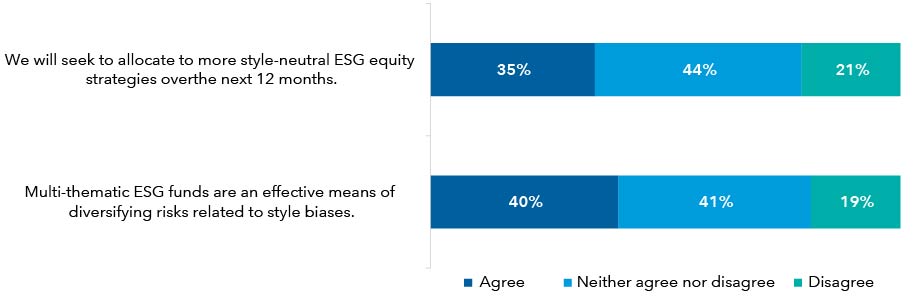

In addition, volatile equity markets – notably the dominance of a small group of growth stocks – has meant the diversifying properties of multi-thematic funds also hold appeal for ESG investors looking to neutralise style biases. More than a third (35%) of those surveyed plan to raise allocations to more style-neutral ESG equity strategies over the next 12 months. Furthermore, 40% of respondents think multi-thematic ESG funds are an effective means of diversifying risks related to style biases.

Respondents’ views on ESG style biases

Sources: Capital Group ESG study 2023

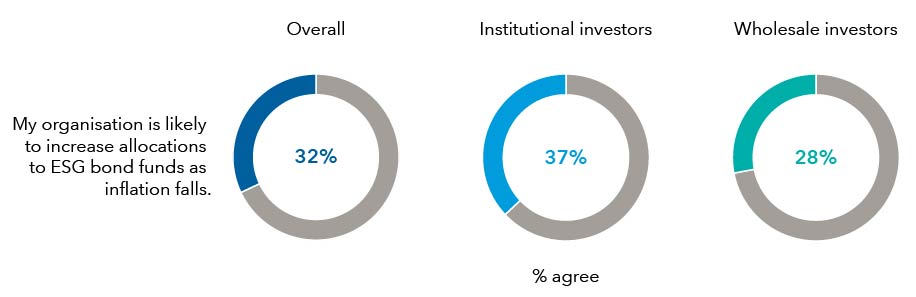

For fixed income investors, inflation is playing a part in their asset allocation decisions. Nearly a third (32%) of the respondents plan to increase allocations to ESG bond funds when inflation falls, with this figure rising to 37% for institutional investors. On a regional basis, more than twice as many investors in Europe, Middle East and Africa (EMEA) are set to raise ESG bond allocations as inflation comes down compared with their North American counterparts (37% vs. 17%).

Respondents’ views on macro factors

Sources: Capital Group ESG study 2023

Regional disparities should not be a surprise

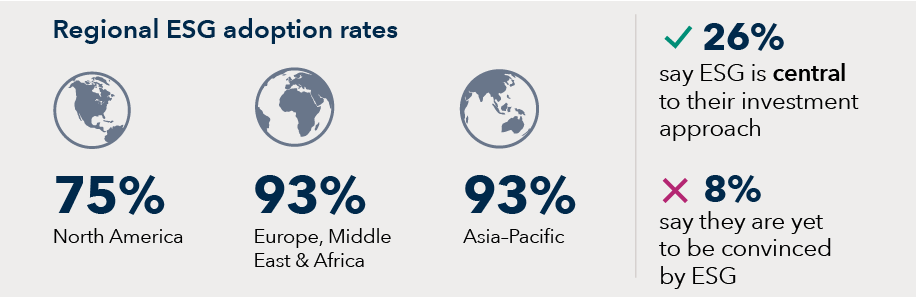

We also saw regional variations in terms of overall ESG adoption. Despite this, the global ESG adoption rate edged up to 90%.

Regionally, ESG adoption in North America has fallen from 79% in 2022 to 75% in 2023. The decline is mostly attributable to the US, where adoption fell from 74% in 2022 to 69% this year. ESG adoption in Canada is far higher at 88%.

Arguably, the modest reversal recorded is not surprising. In the past year, some US states have passed laws and implemented rules designed to curtail ESG in varied ways. More US respondents say the increased scrutiny has changed their approach to ESG (9% vs. 7% in Canada; 8% global).

Sources: Capital Group ESG study 2023

Investors empower themselves to make sense of regulation

Attention to regulatory scrutiny was an issue raised by investors around the world. Seven in 10 (69%) investors say regulatory compliance is either ‘absolutely central’ or a ‘significant part’ of how their firm defines its ESG approach. The importance attached to regulatory compliance and managing financially material risks suggests investors primarily see ESG as a risk factor. They are prioritising the need to avoid reputational damage from regulatory action and financial damage from ESG investment risks.

The task of regulatory compliance is made more difficult by an evolving patchwork of different fund-labelling and fund-disclosure standards. A majority of institutional (52%) and wholesale (54%) respondents say regional variations in fund labelling make it harder for investors to remain true to their ESG objectives.

But when it comes to making sense of regulation, investors are feeling more empowered. More than half of investors surveyed prefer to focus on the underlying fund strategies rather than on regulatory labels, which are seen as a stumbling block.

Indeed, to counter confusion around regulatory labelling regimes, 39% of institutional investors have devised their own set of ESG definitions to ensure teams are taking a consistent approach. Investors are also taking proactive steps to decode data difficulties, including accessing ESG data from multiple sources, leaning on asset managers’ proprietary research and conducting their own analysis. Generally, investors appear to be feeling more proactive and empowered: The more they know about ESG, the more they are finding ways of dealing with its challenges themselves.

Greenwashing1 concerns persist

Despite these positives, broadly, investors think greenwashing is becoming more prevalent. This shifting perception may be indicative of wider media reporting and heightened regulatory action on greenwashing, rather than increased dysfunction. While about 39% say greenwashing was very challenging two years ago, a far higher proportion (59%) see it as a grave challenge today.

A number of factors are shaping perceptions of greenwashing. These include press coverage of high-profile cases of alleged greenwashing, anti-ESG commentary and the reclassification and downgrading of ESG funds.

Some longstanding barriers diminishing, new trends emerging

With the Capital Group ESG Global Study now in its third consecutive year, we are beginning to see how some trends are developing. For example, while investors continue to highlight data quality, regulatory complexity and fund disclosures as barriers to adoption, the level of challenge presented by each of these areas has declined. This suggests some longstanding barriers are starting to diminish.

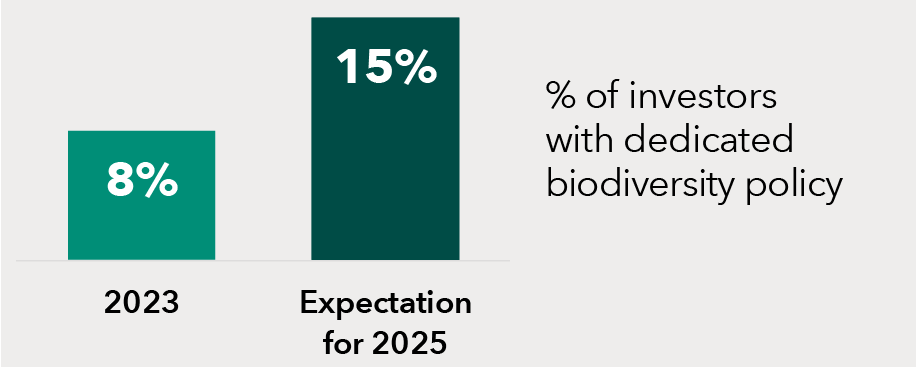

It is also fascinating to observe emerging trends such as the increased focus on biodiversity. International initiatives like the Taskforce on Nature-related Financial Disclosures (TNFD) — which unveiled its finalised recommendations in September 2023 — could serve to further highlight this critical aspect of natural capital.

Biodiversity policies look poised to proliferate

Sources: Capital Group ESG study 2023

The latest study covers these issues and many more. For a more in-depth look at the latest findings, check out the full report.

All data attributed to Capital Group and ESG Global Study 2023 unless otherwise stated.

[1] Interpretations of what constitutes greenwashing can vary, but broadly the term relates to giving a misleading impression on the ESG or sustainability characteristics of a product, activity or organisation.

Our latest insights

RELATED INSIGHTS

Past results are not predictive of results in future periods. It is not possible to invest directly in an index, which is unmanaged. The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment. This information is not intended to provide investment, tax or other advice, or to be a solicitation to buy or sell any securities.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. All information is as at the date indicated unless otherwise stated. Some information may have been obtained from third parties, and as such the reliability of that information is not guaranteed.

Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.