Marketing & Client Acquisition

Planning & Productivity

In 2009, when Michael Novak was building his RIA firm, Wellspring Financial Advisors, a client asked him a provocative question: “Do you have a lifestyle business, or do you have a real business?”

“I was taken aback,” says Novak, Wellspring’s president and CEO. He had a team of six and certainly believed he was running a real business. And he was seeking more of a challenge than simply running a practice to provide him with a nice lifestyle.

That’s when he picked up a book that helped him see the full potential of what his practice could be. Called “Traction,” it describes the Entrepreneurial Operating System (EOS) framework. Novak recalled that he immersed himself in the book during a flight, dog-earing pages and highlighting text. Inspired, he persuaded his partners to deploy EOS to help set priorities and align employees on reaching those goals.

You might think that business planning would take time and effort away from your top priority, which is serving clients. “But we’ve seen that advisors who do business planning are actually better able to offer the kind of more personalized client service emblematic of thriving practices,” says Paul Cieslik, advisor practice management consultant at Capital Group. “And the sooner you can bring business planning into your practice, the greater the multiplier effect can be in driving durable growth.”

In the decade-plus since the Cleveland-based Wellspring made the firmwide commitment to business planning, the RIA has grown from that team of six to 25 — including two partners who started at the firm as interns — with assets under management of more than $3 billion. “Business planning transformed our business,” says Novak.

“Traction” is just one of countless books, websites, assessment tools and other sources available on the market to help business owners professionalize their operations. A few are geared specifically to advisors, such as “one-page” business planning guides offered by financial planner Michael Kitces and consultant Jim Horan.

What most of these frameworks have in common are steps around setting achievable goals, monitoring results and aligning employees around a shared mission. Capital Group’s Business planning blueprint for financial advisors workbook provides details on five such steps and includes a 21-day playbook to help jump-start your efforts.

Pick a framework that feels right to you and get started.

Identify strengths and opportunities

The first step in any program aimed at optimal performance is: Know where you are today. Without understanding your practice’s strengths and weaknesses, it’s difficult to pinpoint where you should focus your planning efforts.

Novak says he and his team worked with an EOS consultant for 18 months to carry out an assessment of the firm. The review confirmed leaders’ belief that Wellspring was great at providing its multigenerational client families with “holistic, one phone call” wealth planning services.

But the assessment also revealed that many of the processes Wellspring had been using to run the firm’s business operations were not as effective as they believed them to be, and that the team was inconsistent about following those processes.

“We were not the finely tuned machine we thought we were,” Novak says. “It was like a duck swimming. While clients saw everything gliding smoothly, under the surface, we were paddling like crazy.”

The assessment, however, gave them a map to help form a more comprehensive plan, which they began at a two-day offsite meeting attended by the management team. During that meeting, the team developed a vision statement that described a high-level mission: We want a referral from every client, and a client from every referral.

The offsite, which the firm holds every year, is also where they discuss and get consensus on Wellspring’s annual goals, often using a SWOT (strengths, weaknesses, opportunities, threats) analysis as a guide. Once the full team is briefed in a subsequent one-day strategy session, employees develop goals to help fulfill their roles in the firm’s plan.

Make sure goals are measurable

BHAG — or “big, hairy, audacious goal” — is a concept you might be familiar with. It’s designed to animate team transformations, and one advisor Cieslik worked with had his BHAG prominently featured on the cover of his business plan: “Grow 10X over the next 10 years.” Crucially, however, once that cover page was turned, the plan inside laid out details and specific steps to meet that big goal.

One way you can ensure your business plan contains viable goals is to evaluate them against SMART guidelines, which call for goals to be specific, measurable, achievable, relevant and time-bound. “If you can’t measure, you can’t manage,” Cieslik says. “If you can’t measure, how do you know if you achieved your goal?”

One of Wellspring’s objectives for 2023 was to develop a strategic marketing plan. The firm has historically focused on client referrals, but decided that marketing was going to be increasingly important for its continued growth.

The measurable steps the team took to meet that goal included hiring an executive to lead marketing efforts, creating a corporate LinkedIn profile, tailoring communications to cultivate centers of influences (COIs), and developing thought leadership to share with clients via email and online.

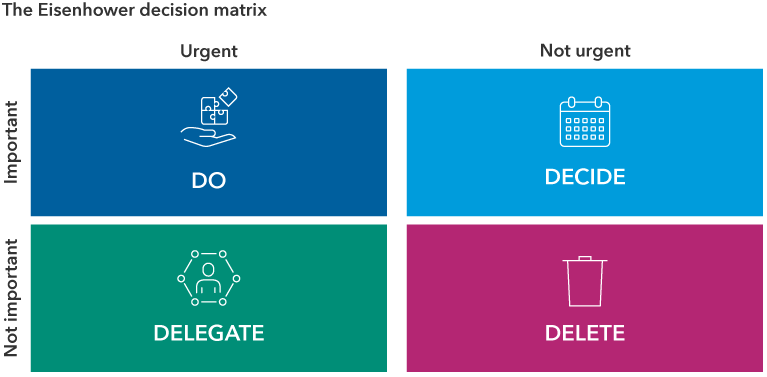

Once you have identified the goals for your firm and employees for the year, an Eisenhower matrix could help you prioritize. The matrix is often attributed to former President Dwight Eisenhower when he was supreme commander of the Allied forces during World War II. This tool requires you to prioritize tasks by urgency and importance, helping you to discern which are top priorities for you to focus on, which tasks can be delegated to others, and which could be deferred to a later date or even deleted.

Visualize your priorities

Source: 7 Habits of Highly Effective People, Stephen Covey.

Get team buy-in and encourage accountability

Even with clearly defined goals, unless your team is fully committed to helping you execute them, your business plan might only gather virtual dust in your documents folder. When Wellspring first introduced EOS, Novak says there was pushback from some employees who didn’t welcome the additional scrutiny into how they got their work done.

To foster greater trust among the team, Novak says Wellspring used — and still uses each year — an employee engagement framework called “The five dysfunctions of a team.” Other frameworks you might find helpful include the Gallup Employee Engagement Model and the Zinger Model.

The point is to encourage honest communication among team members.

Another way to get buy-in is showing team members how business planning can provide greater clarity in how they can be promoted or otherwise progress in their careers. Instead of vague agreements about possible promotions “if you do well,” a business plan can give them specific role definitions and metrics that will be measured to define success.

Once your team is aligned with your business plan and its goals, create a process to help govern how employees each fulfill their part. For example, using EOS, each Wellspring employee is tasked with a “rock” (or specific project) to be completed in 90 days, in addition to their everyday duties. Weekly team check-ins — scheduled for just one hour each week — are when employees can confirm that they’re on track to meet their quarterly goals or share issues that could be hindering their progress.

“It doesn’t mean that everything gets done all the time, but the process requires you to update everyone on where you are on your tasks, and that creates a culture of accountability,” Novak says.

Whichever structure you choose, Cieslik says staying committed to that process is key. “Your team will go through busy times of the year where it might be easy to think it’s OK to skip a check-in or not monitor progress as closely,” he says. “Try to fight against that. Business planning works best if you are consistent.”

Looking back, Novak says deciding to professionalize Wellspring’s operations was a pivotal milestone in the firm’s success.

That client who helped inspire the Wellspring team on this journey? He is still a client, and still asking Novak provocative questions. “He’s proud of where we are, but he’s a hard judge,” Novak says. “He’s constantly raising the bar.”

Financial professionals should review their firm’s compliance policies and procedures prior to engaging in marketing strategies described herein.

SUPPORTING MATERIALS

Paul Cieslik

Paul Cieslik