Washington Mutual Investors Fund

DEFINED CONTRIBUTION FOCUS FUNDS

Seeking to invest in the bluest of blue chip companies

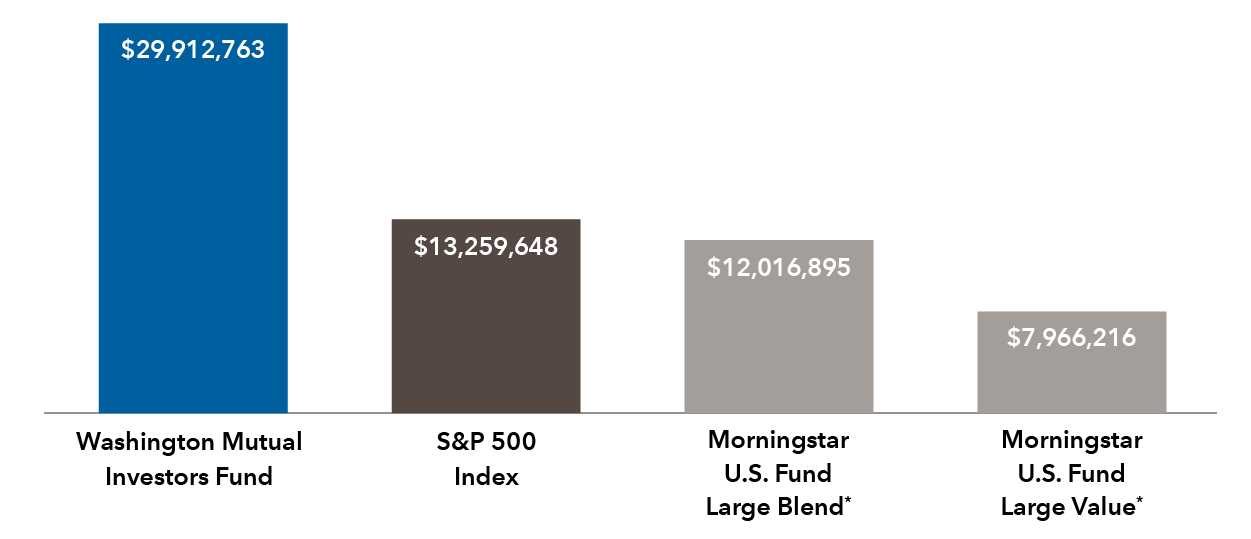

Better results

The value of a hypothetical lifetime investment in the fund would have been more than double that of the S&P 500 and Morningstar peers.

A 70-year legacy of success

Value of hypothetical $10,000 investments since the fund began on July 31, 1952, through December 31, 2022.

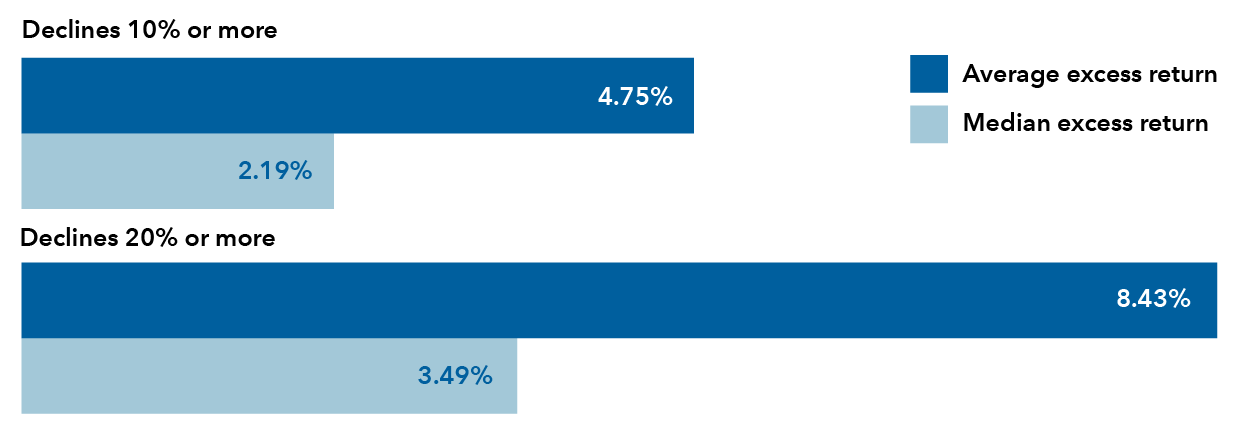

Downside resilience

The fund’s disciplined approach to investing can help limit the impact of declining markets. It led the S&P 500 in all but 3 of the 21 bear markets/corrections in its history.†

Fund excess returns over S&P 500 when the index fell 10% or more, as of December 31, 2022†

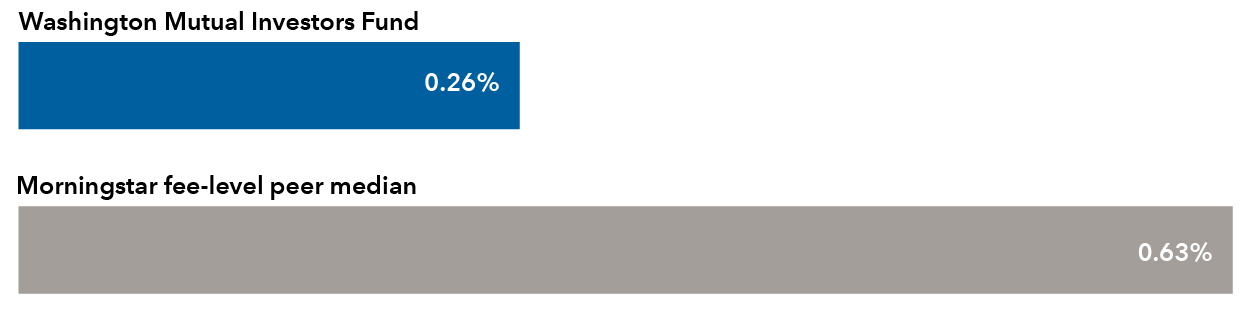

Low fees

The fund's expense ratio was less than half of the median for its peer group‡ 1

Expense ratio1

RECOGNITION

Morningstar Medalist RatingTM

of Gold§

A “most used” defined

contribution plan domestic

equity fund**

How the fund got its name

The fund’s rigorous screening criteria has its roots in a Washington D.C. court case following the Great Depression, which established a list of high-quality stocks appropriate for trust investors.

Want to learn more about the fund?

We're here to help

Our dedicated retirement plan sales support can help you win and retain plans.

*The Morningstar U.S. Fund Large Blend and Large Value data represent category averages. While Morningstar places the fund in the “blend” category, we believe the fund’s qualities are attractive to many investors seeking a U.S. Large Value allocation in their DC plan. The Morningstar category average includes all share classes for the funds in the category. While American Funds R-6 shares do not include fees for advisor compensation and service provider payments, the share classes represented in the Morningstar category have varying fee structures and can include these and other fees and charges resulting in higher expenses. Morningstar U.S. Fund Large Value funds invest primarily in large-cap stocks that are less expensive or growing more slowly than other large-cap stocks as measured by low price ratios, high dividend yields and low growth rates for earnings, sales, book value and cash flow. Large Blend funds invest in a portfolio of large-cap stocks in which neither growth nor value predominates. Large-cap is defined as the top 70% of the capitalization of the U.S. equity market.

†Source: Capital Group. Corrections and bear market periods are defined as price declines of at least 10% (correction) or at least 20% (bear markets) in the index from the fund's inception on July 31, 1952, through December 31, 2022, with 100% recovery between declines. There were 21 periods in which the index fell 10% or more and 10 when it fell 20% or more.

‡The fund’s Class R-6 expense ratio is as of the most recent prospectus available at the time of publication. The peer group expense ratio median was calculated based on funds in the following Morningstar Fee Level Group — Distribution category: Large Cap Retirement, Large, as of December 31, 2022.

§As of July 11, 2023, based on Class R-6 shares.

**Source: “Mutual funds most used by DC plans, by asset class 2022,” Pensions & Investments, November 2, 2022, based on assets as of June 30, 2022, U.S. equity category.

Unless otherwise indicated, data is as of December 31, 2022, and fund data is for Class R-6 shares.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. The index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

- Class R-6 shares were first offered on 5/1/2009.

- Expense ratios are as of each fund's prospectus available at the time of publication.